Acknowledgement for the rightful claims or accomplishments

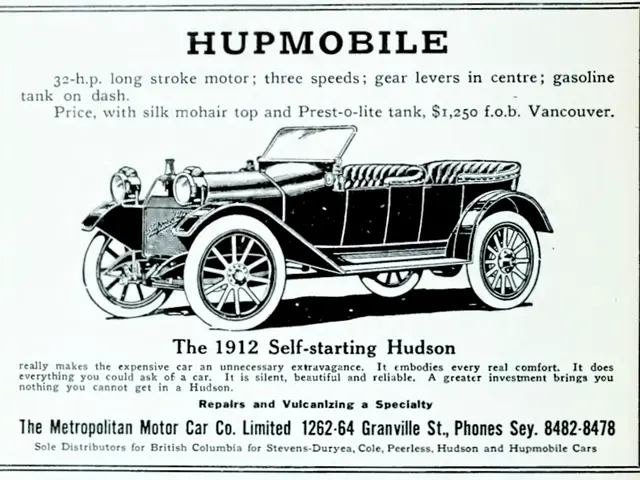

Consumers often overlook the costs associated with auto loans when purchasing a car, leading to a preference for relatively expensive loans. According to a study by Christopher Palmer, an associate professor of finance at the MIT Sloan School of Management, this behavior causes individuals to buy older vehicles with lower sticker prices.

When financing costs rise, consumers may be deterred from buying new cars due to increased expenses over time. Consequently, they might opt for older or pre-owned vehicles, which are less impacted by high interest rates. Some consumers may choose extended payment periods to manage costs, while others might defer purchases until their finances improve.

Palmer, who conducted research examining millions of U.S. car loans, discovered this trend. His work emphasizes a focus on hard data and fresh perspectives when it comes to personal financial management.

In light of Palmer's research, it is evident that an increase in financing costs could impact consumers' car-buying decisions. However, it is necessary to examine studies that directly address how financing costs influence consumer choices regarding the age of the purchased car to understand the specific impact.

Considering the potential consequences of higher financing costs on purchased car age, consumers should carefully consider their financing options and weigh the total cost of a new or used vehicle amid fluctuating interest rates.

When making decisions about car buying, consumers may be influenced by financing costs, leading them to consider investing in older or pre-owned vehicles to avoid increased expenses over time. As a result, it is crucial for people to research various financing options carefully, taking into account their personal-finance situation and the total cost of either a new or used vehicle amid fluctuating interest rates.