Bitcoin lingers at the brink of pivotal $92K threshold – Unveiling future prospects

Bitcoin is at a crucial crossroads right now, with the digital currency hanging around the $92,500 mark. This is a key area where short-term momentum and bearish resistance clash.

With over-leveraged positions reaching $70 billion, the market is as taut as a bow string, ready to spring in either direction. So, are we headed for a bull run or a bear market plunge? Let's dive in and find out.

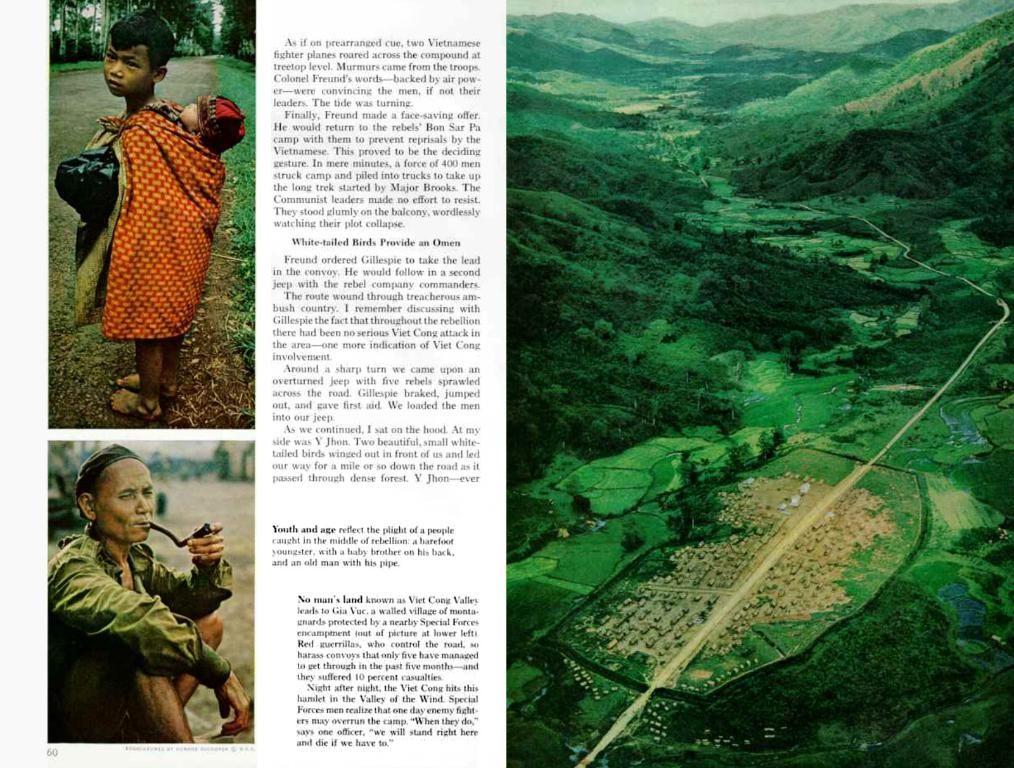

The volatile short-term holder perspective

Historically, when Bitcoin trades significantly above the Short-Term Holder (STH) realized price, it often signals overheated market conditions - usually followed by corrections, as marked by the red arrows. On the other hand, green arrows highlight instances where the price held or reclaimed this level, often signaling bullish shifts. At the moment, Bitcoin is almost touching the STH realized price, making it a critical decision zone.

Meanwhile, the STH-MVRV ratio is nearing the neutral 1.0 mark from below - an area historically associated with accumulation or impending upside volatility.

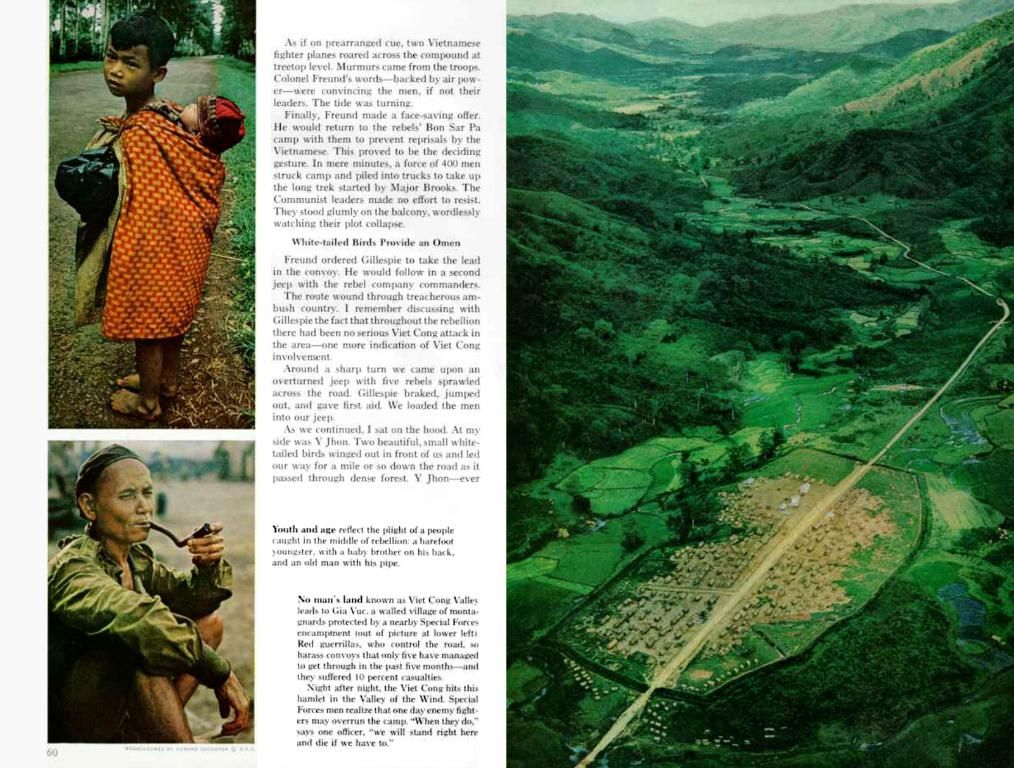

The force of impulse and leverage

An exploration of Bitcoin's on-chain data reveals a market gearing up for action. Deep analysis shows that the Realized Cap Impulse and Long-Term Realized Cap Impulse Indicators both hover near critical support zones. Historically, such low readings have often coincided with significant price expansions after periods of inertia, hinting at potential for a volatility surge.

Source: Alphractal

In addition, the Open Interest is still high, exceeding $70 billion. This accumulation of leveraged positions usually presages big price swings, as flurries of liquidations occur.

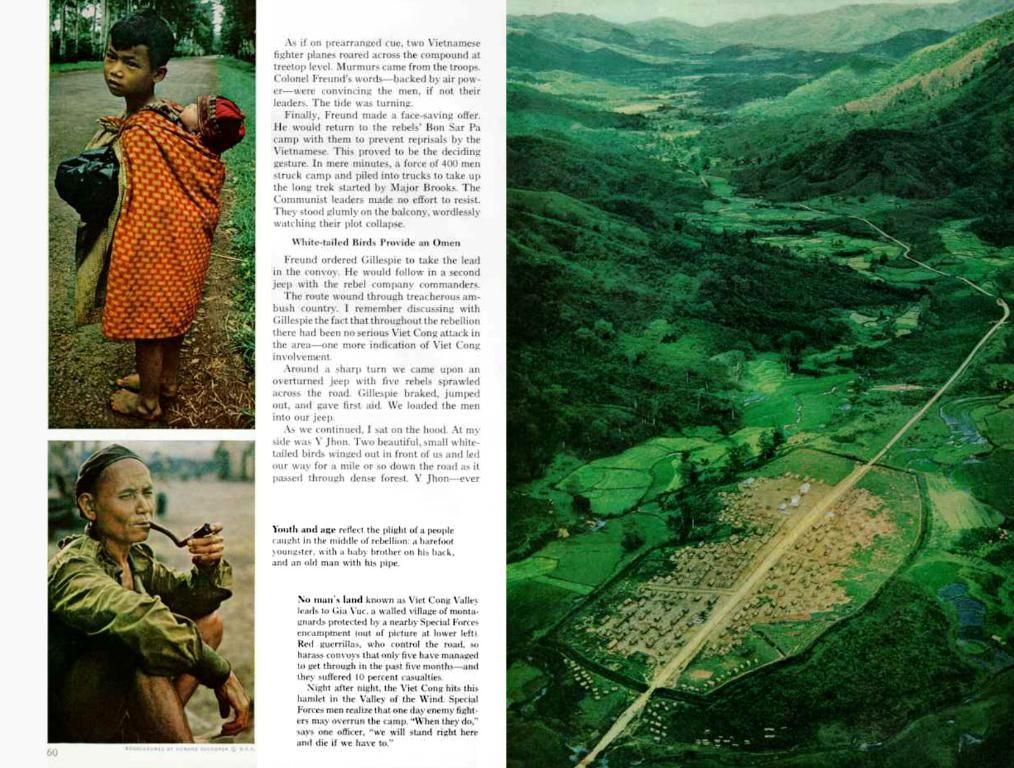

Possible outcomes

The battle for Bitcoin's price direction is intense. Bulls are aiming to reclaim higher ground, which could tilt the momentum in their favor. A decisive break above $92,500 could trigger fresh buying, leading to short liquidations and possibly fueling a swift upward trend.

However, bears are fiercely guarding this level. If they fail to hold, they risk a sharp drop as over-leveraged long positions get squeezed out in a mass sell-off. With the Open Interest still elevated, any breakout could trigger a chain reaction in either direction.

Don't forget to participate in our survey and stand a chance to win $500 USDT! We want to know your thoughts on the Arbitrum rally and whether this growing long bias can translate into a rapid bull run.

Sources:1. [1] Yahoo Finance2. [2] CoinMarketCap3. [3] Blockchain.com4. [4] Cointelegraph5. [5] Bloomberg

- Despite Bitcoin being at a crucial crossroads, hanging around the $92,500 mark, its proximity to the Short-Term Holder (STH) realized price indicates a critical decision zone.

- The STH-MVRV ratio is nearing the neutral 1.0 mark, historically associated with accumulation or impending upside volatility.

- Analysis of Bitcoin's on-chain data reveals a market gearing up for action, with the Realized Cap Impulse and Long-Term Realized Cap Impulse Indicators hovering near critical support zones.

- High Open Interest, currently exceeding $70 billion, accumulation of leveraged positions usually presages big price swings, as flurries of liquidations occur.

- If bulls manage a decisive break above $92,500, they could trigger fresh buying, leading to short liquidations and possibly fueling a swift upward trend.

- However, if bears fail to hold this level, they risk a sharp drop as over-leveraged long positions get squeezed out in a mass sell-off, potentially leading to a chain reaction in either direction.