Stashing Billions in Cash: The Persisting Presence of Greenbacks in an Electronic Age

- *

Cash Hoards Persist: Accumulated Money Still Increasing - Cash hoarding persists: ongoing increase in hidden financial assets

The persistent rumblings of the impending death of cash are heard, but unmistakably premature: As the importance of notes and coins dwindles in everyday commerce, the volume of cash circulating within the euro region continues to escalate. Central banks and experts posit that cash worth billions is not being spent, but rather hidden.

Estimated: Four hundred billion euros in private households' cash stashes

As per data from the German Central Bank, around 42% of banknotes in Germany are held for 'asset preservation', almost double compared to 2013. By the end of 2024, the German Central Bank estimates that 395 billion euros were held by German private households - unevenly distributed, with many households owning little to no cash reserves.

"The Cash Enigma"

According to statistics from the European Central Bank, there were 1.564 trillion euros in circulation across the euro region in March. This was 30 billion more than in the spring of 2022 and a staggering 300 billion euros more than at the onset of the Coronavirus pandemic five years ago. While the growth rate has significantly slowed down since 2022, the volume of cash in circulation continues to climb, rather than decline. The German Central Bank terms this phenomenon the "cash enigma". "This trend has persisted for several years, across multiple countries," says a spokesperson from the German Central Bank in Frankfurt.

"Prior to 2021, the growth rate of banknotes in circulation was consistently multiple times greater than the annual inflation rate," reveals Johannes Gaertner, a payment expert at the consulting firm Strategy&.

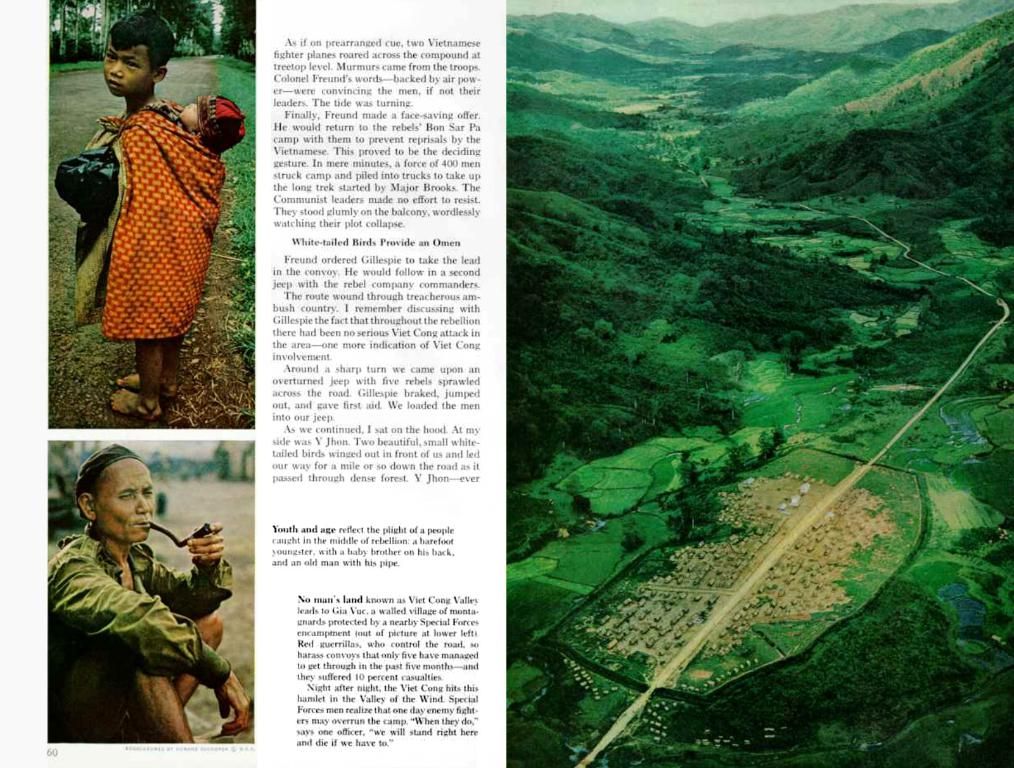

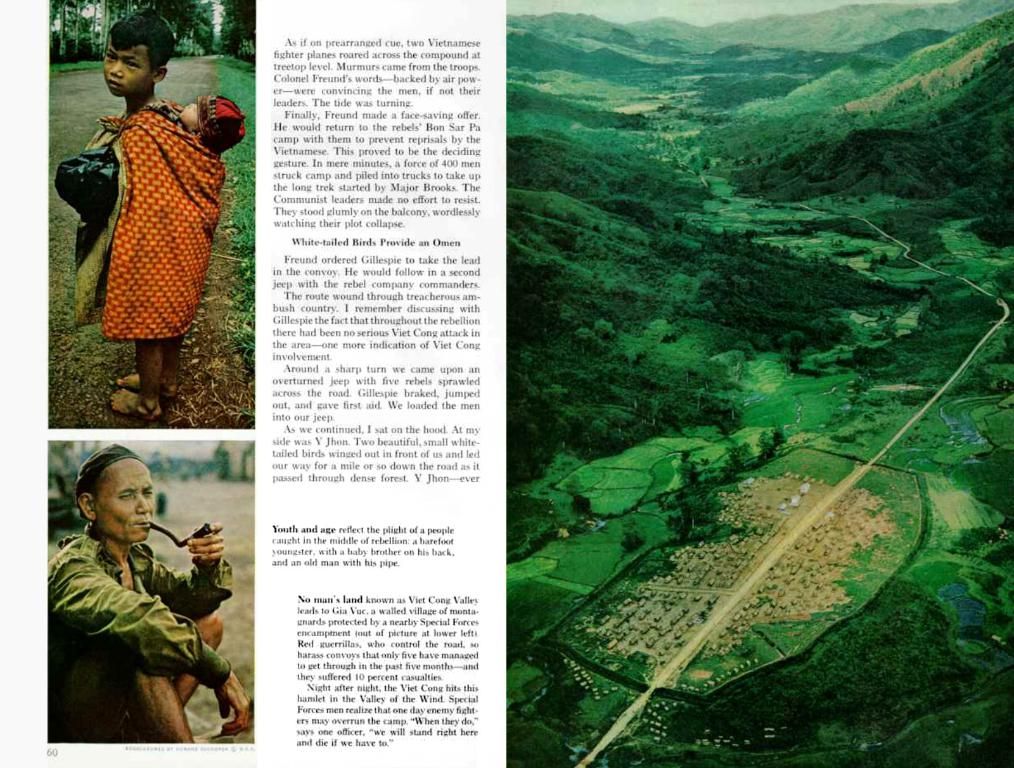

The enigma is perplexing as it's commonly accepted that the number of individuals utilizing cash is on a steady decline. In 2023, as per the German Central Bank, half of all payment transactions at German cash registers still relied on cash, but this accounted for just a quarter of the total transaction value.

Electronic Transactions on the Ascendency

A recent survey by Strategy& of 5,500 respondents from nine European countries and Turkey has found that the debit card has surpassed cash as the most frequently used payment method, with only 23% preferring cash. Many retailers also increasingly favor electronic transactions, particularly contactless payment, which bypasses the need for customers to input a PIN. "This eliminates several steps compared to cash payment, making it up to seven times faster," says Bernd Ohlmann, spokesperson for the Bavarian Retail Association.

"Uncertainty is the fuel"

But why is there more cash circulating when it is used less frequently in everyday life? "The euro is being hoarded extensively," states Ralf Wintergerst, CEO of the Munich-based banknote and security technology manufacturer Giesecke+Devrient, which counts approximately 150 central banks among its clients. "The production volume for euro banknotes is being deployed for transactions, however, it's also being set aside." Wintergerst has been involved in discussions with central banks regarding cash supply and usage for decades: "What occurs in the cash flow, why, and for what purpose do people use cash?" Wintergerst offers a theory for the continual trend of cash hoarding: "Uncertainty is the driving factor."

According to the Bundesbank, the proportion of cash stored for asset preservation peaked at 43% during the Coronavirus pandemic, largely due to the extended lockdowns in the initial phase. "The increase in the circulation of banknotes during crises, not just the Coronavirus pandemic, due to the uncertainty associated with them, is a frequently observed phenomenon," asserts a Bundesbank spokesperson.

Cash Remains the King of Criminal Activities

Business consultant Gärtner proposes two further explanations contributing to the increased cash circulation. "In essence, growth in the money supply bears little relation to traditional payment transactions," reveals the financial expert. "The reasons stem from 'hoarding', shadow economy, and its role as a reserve currency abroad." The term 'shadow economy' refers to economic activities beyond the law, encompassing both informal labor and illegal activities.

For instance, the A3 motorway in Bavaria is well-known for customs officers discovering substantial cash during checks: In November, they found over a million euros in a car belonging to a 34-year-old man, presumed to be related to criminal activities and stacked in plastic bags.

However, even with the declining relevance of cash in the lives of law-abiding citizens, it's unlikely that only criminals will be carrying notes and coins in the future. The Bundesbank regards it as its duty to maintain cash and its infrastructure. "Cash possesses undeniable advantages," asserts G+D CEO Wintergerst. "Notes and coins do not require electricity or electronic infrastructure. The central bank must ensure a sustainable, resilient payment infrastructure. When there is war, crises, or natural disasters, it must still be possible to pay. That is what cash is for."

- German Federal Bank

- Omen (Psychology)

- Couch

- Germany

- Frankfurt

- COVID-19

- Ralf Wintergerst

- Munich

- Bavaria

- ECB

- Season

- Consulting firm

Insights:

- Economic Uncertainty: Individuals might hold more cash during times of economic uncertainty, serving as a precautionary measure against potential financial instability caused by geopolitical tensions, policy uncertainties, or other events.

- Inflation and Interest Rates: High inflation rates and low or negative interest rates might prompt individuals and businesses to hold more cash, anticipating future price increases or economic fluctuations.

- Crisis Preparedness: The European sovereign debt crisis teaches people the importance of cash reserves, acting as a safeguard against potential disruptions in financial systems.

- Psychological Factors: Some individuals may prefer to hold cash due to psychological reasons, such as feeling more secure or possessing a tangible asset.

- Black Market and Tax Evasion: Cash may be used in unauthorized transactions and is more prevalent in countries with sizeable black markets or where tax evasion is common.

- To address the persisting issue of cash hoarding, community policy and employment policy should take into account the role of cash as a safeguard during times of economic uncertainty.

- Businesses, particularly in sectors susceptible to unauthorized transactions, should implement robust financial practices, ensuring compliance with personal-finance regulations to minimize reliance on cash and reduce opportunities for tax evasion.