Unfiltered Insights on S4 Capital and the Donald Trump Tariff Effect

A Shift in Advertising Giants under Pressure from Trump's Tariffs

Clients show wariness as S4 Capital's earnings significantly decline, according to Sir Martin Sorrell

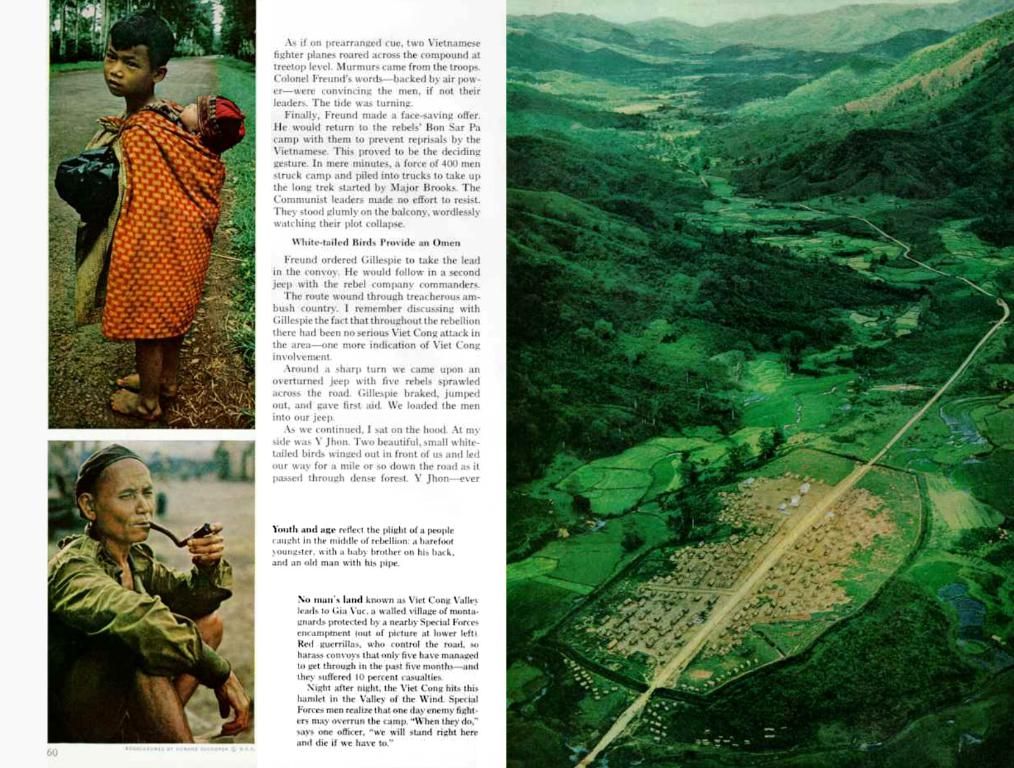

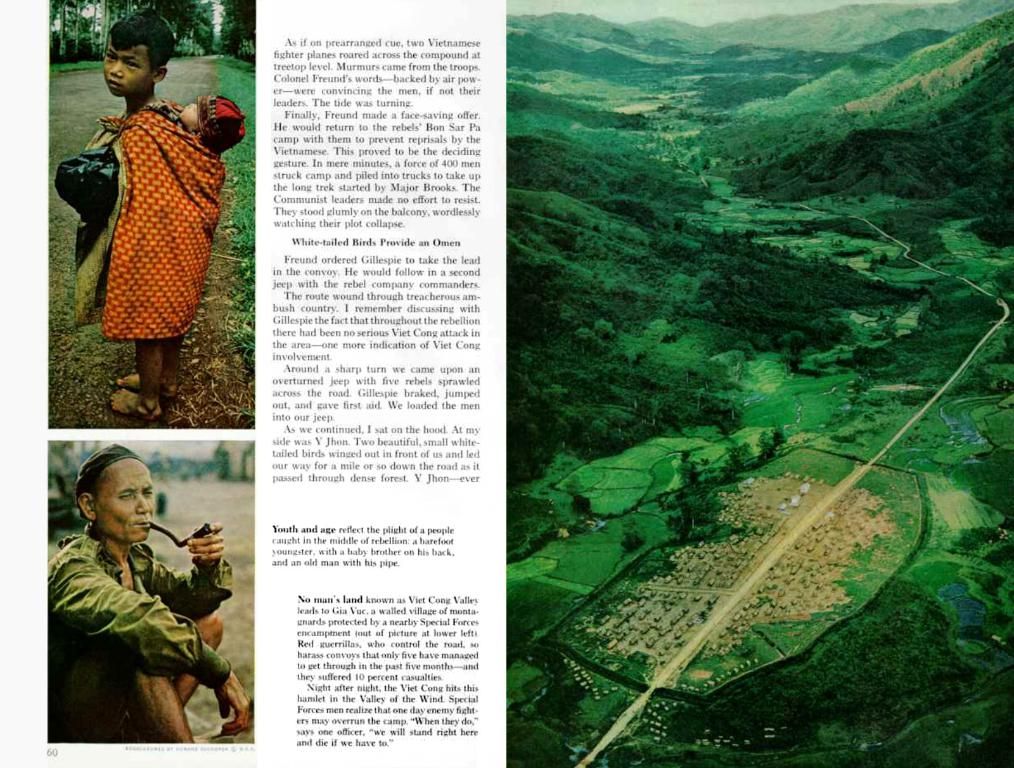

The advertising world,, spearheaded by S4 Capital, Sir Martin Sorrell's empire, has taken a hit due to the volatile global economic conditions instigated by President Trump's tariff policy. S4 saw a 11.4% drop in revenue in Q1 of 2025, attributed to client caution and headwinds from a key client., With the company's losses widening to £306.9m at the end of 2024 compared to £14.3m the year prior, and revenue decreasing by 13.6%, Sorrell has voiced concerns about global economic policy uncertainty, particularly tariffs.

The Tech Sector Squeezed by White House Trade Offensives

Notably affected by Trump's trade policies, the tech industry has faced steep challenges. Shares in Apple have dropped by nearly 20% for the year, and Elon Musk's Tesla plunged by 27%. The tech sector, grappling with trade tensions since President Trump's inauguration, has been bombarded by unstable markets due to the President's frequent changes in tariff exemptions.

The Tariff-Laden Future of Advertising and Investments

The broader implications of these trade tensions on the advertising industry and spending can't be ignored. The unexpected uncertainty has led to clients acting cautiously, resulting in a reduction in marketing budgets in favor of AI and technology investments. Analysts predict U.S. social ad spending could be slashed by as much as $10 billion in 2025 due to tariffs, causing advertisers to reconsider their digital ad plans and reduce spending by approximately 7% in Q1 of 2025.

Former S4 Capital finance boss, Mary Basterfield, announced her departure from the firm in January, serving as the chief financial officer since January 2022. Despite the headwinds, S4 Capital reaffirmed its full-year targets, anticipating a greater second half weighting and normalizing tariff levels to boost client confidence and selectivity in geographical operations.

- Sir Martin Sorrell, amidst the slump in S4 Capital's revenue due to global economic uncertainties and tariff-related headwinds, has warned about the potential dangers posed by policy inconsistencies, particularly tariffs.

- The tech sector, hit hard by the White House's trade offensives, continues to face challenges as trade tensions augmented by President Trump's frequent changes in tariff exemptions have triggered unstable markets.

- Confronted with these volatile conditions, clients have been hesitant to invest, resulting in a shift towards AI and technology investments, while reducing marketing budgets. Analysts project a potential cut of $10 billion in U.S. social ad spending in 2025 due to tariffs.

- In the aftermath of these difficulties, S4 Capital's former finance boss, Mary Basterfield, parted ways with the firm in January, following her tenure as chief financial officer since January 2022.

- Despite the adversities, S4 Capital remains optimistic, maintaining their full-year targets, and anticipating a more robust second half and normalizing tariff levels to boost client confidence and strategy in geographical operations.