ECB President's Concerns about Inflation Remain Unaddressed Post July Meeting Discussion

Rewritten Article:

Central Bank Keeps Inflation Aloof, Says Top Economist Schnabel

Isabel Schnabel, a top economist at the European Central Bank (ECB), shared candid insights with Reuters, stating that the inflation landscape remains unchanged since July's ECB meetings, as published in an interview on Thursday. She said, "Our decision in July for a 50 basis point hike stands, as I don't think the inflation outlook has fundamentally changed." The ECB is now adopting a flexible approach, making decisions based on new data. She added, "Looking at the recent data, I can't say our worries from July have vanished." The ECB's next monetary policy meeting is coming up on September 8.

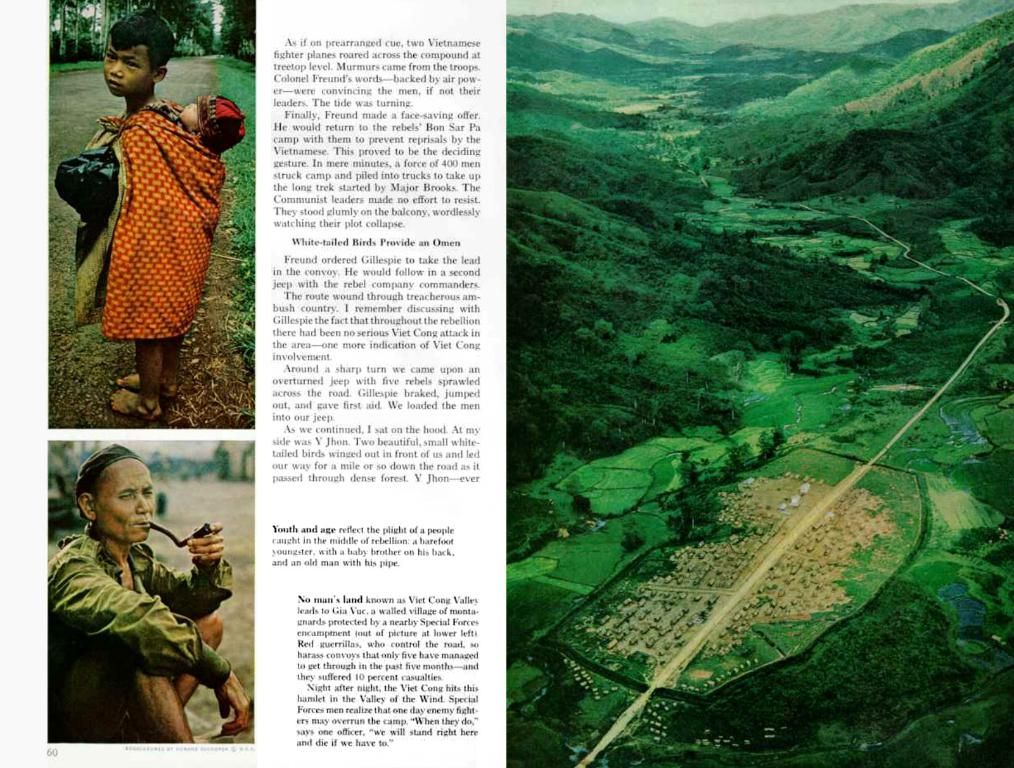

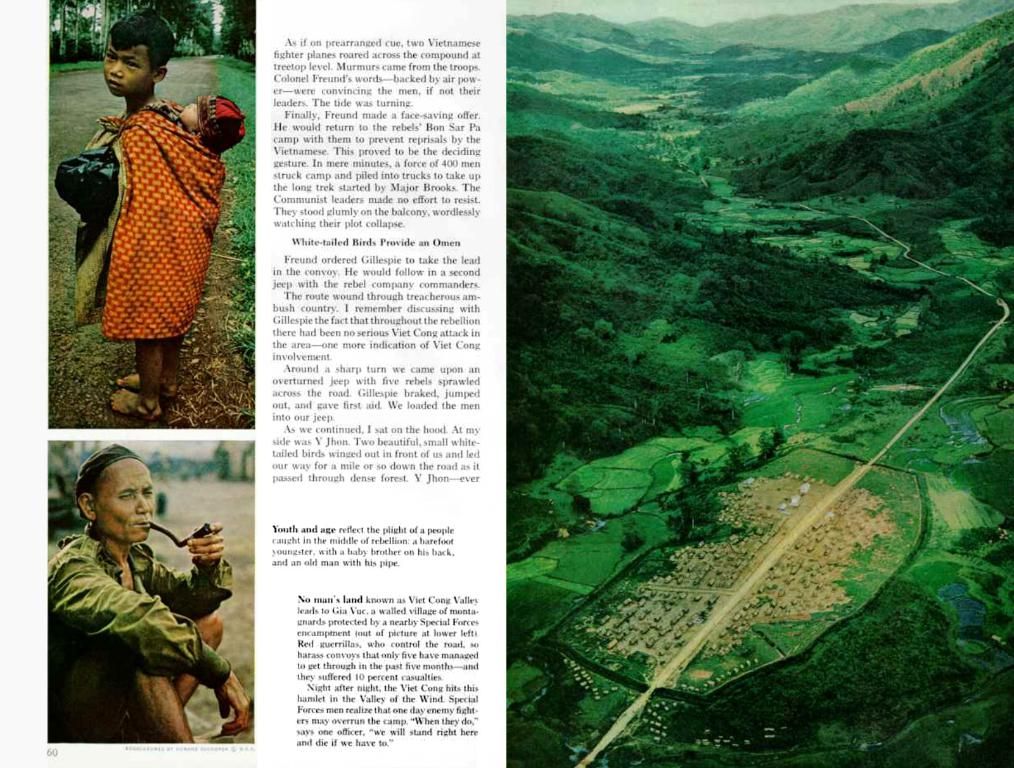

German economist Schnabel, responsible for market operations in the ECB's executive board, reported that the euro zone witnessed a historic high of 8.9 percent inflation in July, fueled by surging energy costs stemming from the Ukraine war and food price rises. This marks more than fourfold the ECB's target of a 2 percent inflation rate.

"I wouldn't rule out a short-term increase in inflation," Schnabel admitted. Now, the inflationary pressure is disturbing not only energy and food but also services and industrial goods. "It's a widespread trend", she mentioned. And the inflationary pressure is unlikely to ease swiftly: "Even with the current normalization of monetary policy, it would take time for inflation to fall back to 2 percent." Schnabel suggested that Germany might witness a rise in inflation, and some economists even predict double-digit inflation rates in the fall due to rise in gas prices and a new gas surcharge.

Schnabel also addressed the risk of long-term inflation expectations spinning out of control, deviating from the central bank's 2 percent target. Most measurements remain at the mark, she said, but some signs point to an elevated risk. "It's crucial we pay attention to such signs", she declared. The central bank terms this risk as the dread of "de-anchoring" inflation expectations.

RECESSION'S GRUMBLINGS

The ECB's interest rate hike comes at a time of deteriorating prospects for economic growth in the Eurozone. Higher interest rates may further dampen the economy. Schnabel, however, pointed to a robust labor market and a positive second quarter performance, plus sectors like tourism that have demonstrated remarkable resilience. Nevertheless, she warned, "We're seeing strong indications that growth will slow, and I wouldn't rule out a technical recession." This is particularly probable if energy supplies from Russia are further disrupted. Economists define a technical recession as an economy shrinking in two back-to-back quarterly periods. The Eurozone managed a 0.6 percent growth in the second quarter.

The Eurozone must cope with additional hindrances such as drought and declining water levels in major rivers, Schnabel emphasized. Overall, the risks to growth have increased. "Germany appears to have been hardest hit among larger Eurozone countries," she observed. However, she doesn't currently perceive signs of a prolonged, deep recession. In her opinion, a shrinking economy alone would not lead to inflation falling back to the ECB's target. "Even if we enter a recession, it's quite unlikely that inflationary pressure will ease independently", she explained. Now, the economy must weather a shock that slows growth while increasing prices.

Sources:- [1] ECB Interest Rates (n.d.). Investopedia. Retrieved March 24, 2023, from https://www.investopedia.com/terms/e/ecbinterestrates.asp- [2] Inflation Rate in the Eurozone [EZCPI]. Trading Economics. Retrieved March 24, 2023, from https://tradingeconomics.com/euro-area/inflation-cpi- [3] Eurozone Inflation Rate Forecast 2022-2026 (2022). MacroTrends. Retrieved March 24, 2023, from https://www.macrotrends.net/1369/eurozone-inflation-rate-historical-and-forecast-inflation-rate-inflation-rate-forecast- [4] ECB rates set to peak in -0.10% before slowing rate hike cycle in H2 (2022). Reuters. Retrieved March 24, 2023, from https://www.reuters.com/business/europe/ecb-rates-set-peak-in-01-before-slow-rate-hike-cycle-h2-2022-05-06/- [5] A Recession in the Eurozone: How Likely Is It? (n.d.). Investopedia. Retrieved March 24, 2023, from https://www.investopedia.com/articles/analysis-isds/072414/recession-eurozone-how-likely-it.asp

- The European Central Bank (ECB) maintained its stance on inflation, with top economist Isabel Schnabel saying the decision to increase rates by 50 basis points in July remains unchanged, despite growing inflationary pressure.

- Schnabel, who is responsible for market operations in the ECB's executive board, seriously warned that the inflation rate in the euro zone might even reach double-digit figures in the fall due to rising gas prices and a new gas surcharge.

- According to Schnabel, the ECB is vigilant about the risk of long-term inflation expectations spinning out of control, deviating from the central bank's 2 percent target.

- Amid deteriorating prospects for economic growth in the Eurozone, Schnabel acknowledged the potential for a technical recession, but also emphasized that a shrinking economy alone may not lead to inflation falling back to the ECB's target.