Enhanced Financial Policies in Beijing Forecast to Strengthen Macao's Gambling Industry

Revamped Journey: Macao's Casino Saga Rides China's Economic Wave

Set sail with us on a rollercoaster ride as we dissect the intriguing symphony of China's economic stimulus package and Macao's casino sector. Fasten your seatbelts, folks, as we delve deep into the dance between Beijing's moves, Macao's casino industry, and the economic tides of the Dragon Kingdom.

Beijing's latest economic extravaganza, projected to prop up consumer spending and inspire confidence, might just be the golden ticket Macao's casino sector craves for. Seaport Research Partners has its eye on this grand play, forecasting the stimulus to serve as a boon for Macao's gambling realms throughout the long haul.

Vitaly Umansky, the sharp-eyed senior analyst at Seaport Research Partners, paints an optimistic picture. He tells GGR Asia that China's latest moves will likely remain loyal companions to the gambling industry, well past 2025. This grand plan for prosperity from Beijing includes refining wage-adjustment mechanisms, amplifying property income avenues, and blowing new life into existing levels of consumer capacity. Direct cash handouts seem to be Missing in Action, but the focus on nourishing consumer power sends a powerful message about China's commitment to a speedy economic revival.

Umansky further throws a spotlight on recent shake-ups in travel policies between mainland China and Macao, making the pearl city even more radiant for tourists and gamblers. His crystal ball predicts that these adjustments shall help bolster demand growth for Macao in the mid-term, enhancing consumer confidence and wallets to support Macao's base mass market customers.

The Mass Market Struggles to Stand Tall

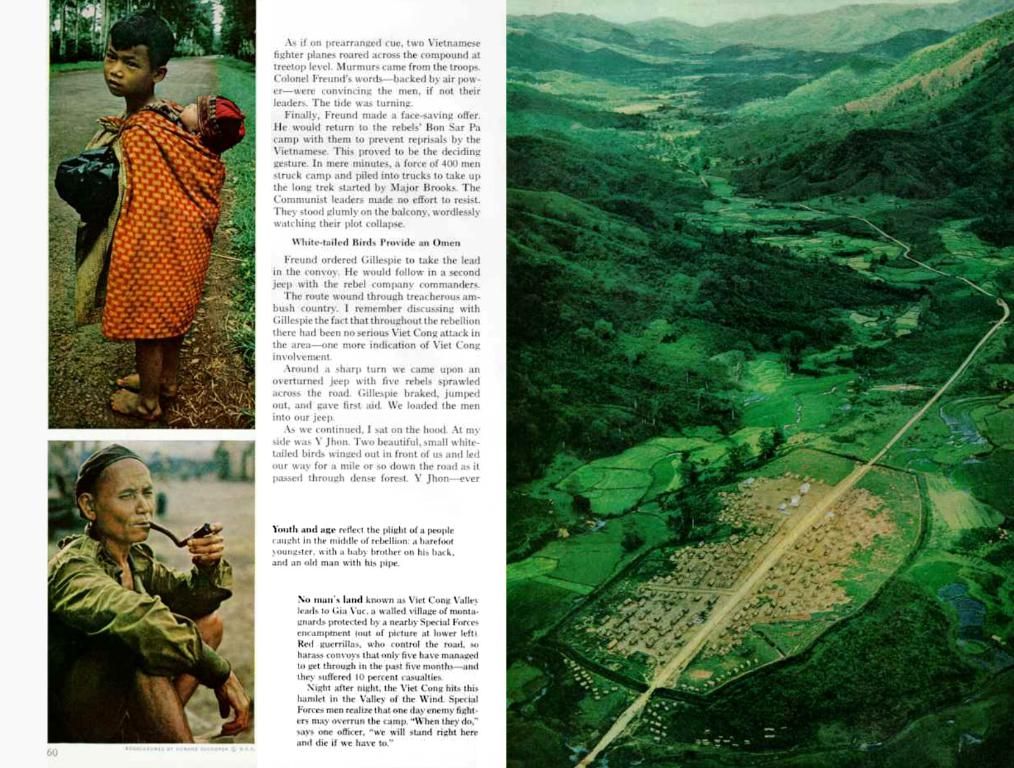

Though Macao's casino industry is fighting a five-round boxing match against the COVID-19 pandemic, the base mass market is still feeling the pressure. According to Seaport's data, the number of overnight tourists from Guangdong and Hong Kong plummets by 15%, while this crucial sector languishes 15% below its 2019 levels.

Fear not, for Macao's premium gaming market stands resilient, helping the total revenue to soar. As investment rises and confidence returns, the prophets of the industry envision a gradual recovery for the mass market.

Fitch Ratings casts a shadow of concern over some structural issues haunting China's economy. Despite the optimism surrounding China's stimulus initiatives, the effectiveness of these measures might be checkmated by entrenched hurdles such as economic uncertainty, demographic changes, or excess local government debt.

Yet the industry prognosticators see a silver lining, tuned to Beijing's harmonious melody of stimulus policies, relaxed visa regulations, and travel ease. This music is expected to attract a constant flow of tourists to Macao, sustaining the city's gaming revenue growth for the foreseeable future.

Enrichment Data:

This economic symphony is played out on two distinct stages:

- Infrastructure-Driven Tourism Boost:China's stimulus directives, including the issuance of 1.3 trillion yuan ($178 billion) in ultra-long-term special bonds[1] and potential fiscal measures in response to U.S. trade tensions[2], could bolster Macao's casino sector through two primary channels:

- Cross-border infrastructure improvements, focused on key national projects, might foster better travel connections between mainland China and Macao. Upgraded transportation networks (e.g., enhanced rail links, streamlined immigration processes) could fuel higher visitation volumes, directly strengthening mass-market casino revenue.

- Consumer Confidence & Spending:The stimulus's primary aim of fortifying the Chinese economy amid external stresses[2] might create a ripple effect on Macao, indirectly.

- A thriving mainland economy translates to increased disposable income, which in turn could stoke desires for discretionary spending on gambling and leisure travel in Macao's mass-market segment.

In the long run, however, diversification pressures await Macao, as stimulus funds may steer toward non-gaming sectors like cultural tourism or MICE (meetings, incentives, conferences, exhibitions) facilities. Tragically, prolonged U.S.-China trade tensions[2] could siphon resources away from consumer-facing initiatives critical to Macao's recovery, impacting the success of Beijing's grandeur plan.

The outcome hangs on how successfully China conjures up consumer fervor and if infrastructure investments genuinely enrich Macao's accessibility for mainland tourists. It's a dance of hopes, risks, and the pulsating heartbeat of two titans joining hands in a dramatic twist of destiny. Stay tuned for more as this saga unfolds!

- By 2025, Vitaly Umansky, the senior analyst at Seaport Research Partners, expects China's policies to remain supportive of Macao's gambling industry, aiding in the enhancement of consumer capacity, property income avenues, and wage-adjustment mechanisms.

- The base mass market in Macao's casino sector continues to struggle, with overnight tourists from Guangdong and Hong Kong decreasing by 15%, and the sector still falling 15% below its 2019 levels.

- China's stimulus initiatives, including infrastructure improvements and consumer confidence boost, are predicted to attract a steady flow of tourists to Macao, contributing to the growth of the city's gaming revenue.

- Despite the optimism surrounding China's stimulus policies, Fitch Ratings raises concerns over structural issues such as economic uncertainty, demographic changes, and excess local government debt that might limit the effectiveness of these measures.