Let's Chat About state Intervention and Private Investment: Veronika Grimm's Take

lz Frankfurt

Excessive Government Regulation Stifles Investment, Argues Grimm

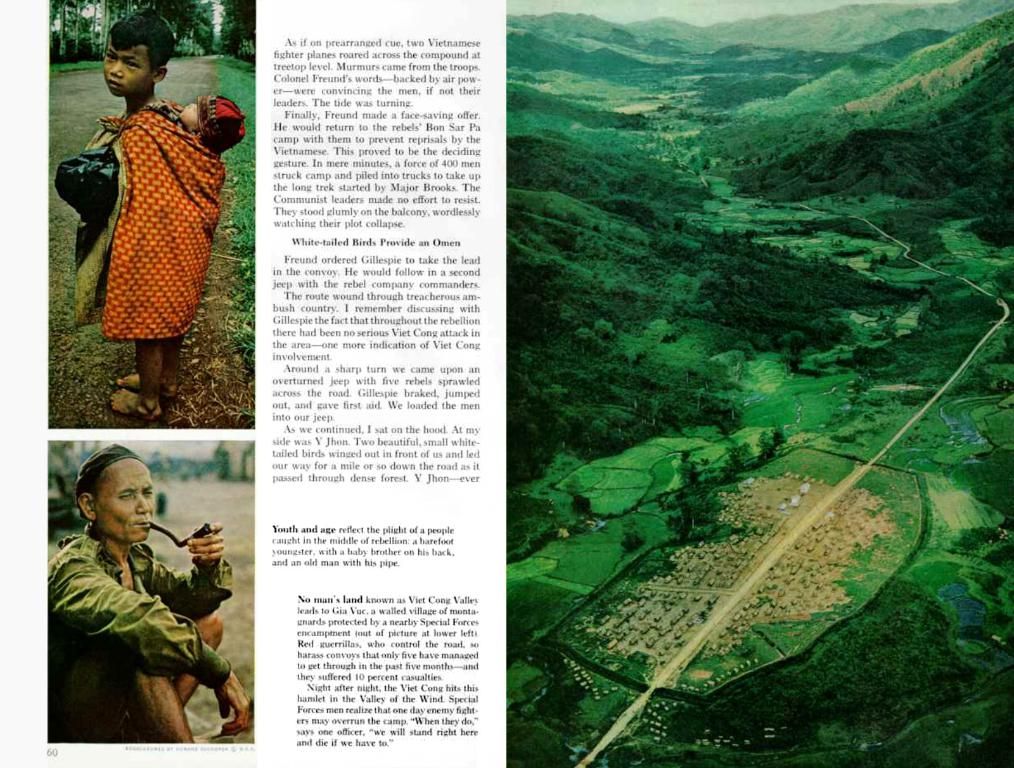

Economist Veronika Grimm voiced her opinions on the need for political leaders to present a plan for scaling back the government's influence. In a talk at the Institute for Monetary and Financial Stability (IMFS) in Frankfurt, she reasoned that decreasing the state's impact would spur greater private involvement in those sectors, driving up investments. This is because the government's slow reaction and indecision keeps investors guessing, and it commits itself to activities that typically fall outside the state's jurisdiction.

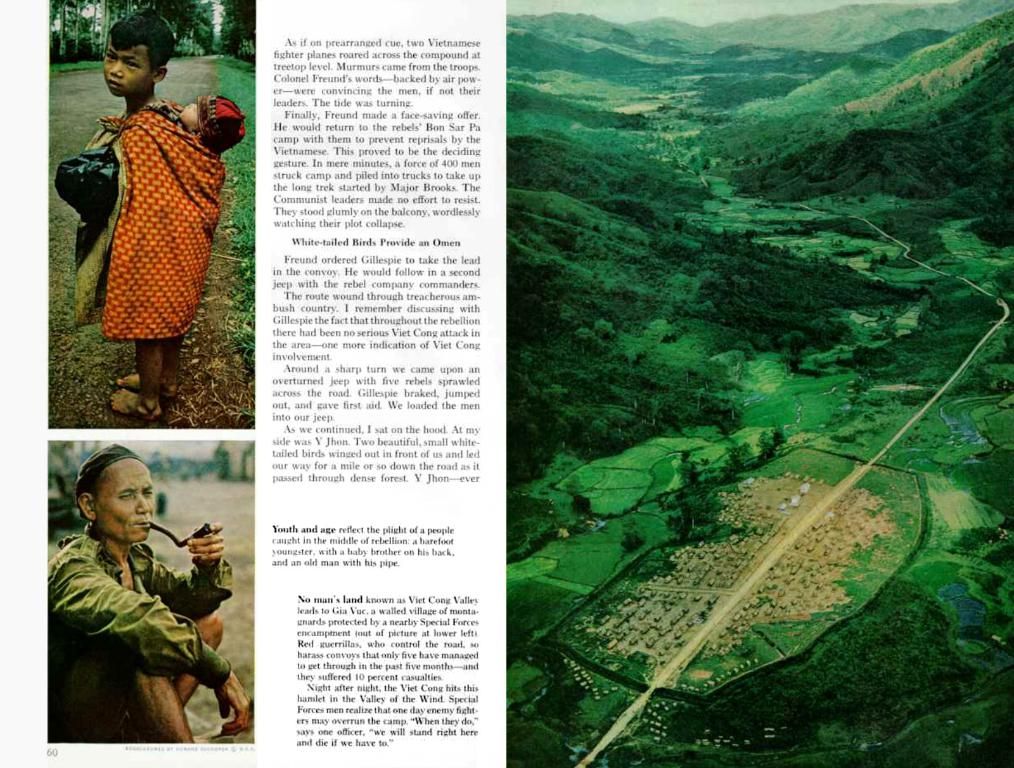

To put it simply, the government, with its sluggishness and indecisiveness, serves as a hindrance to private investment. A reduction in the state's role would unleash a wave of entrepreneurship and innovation.

Sequestered corners of the market would see new investments flowing in, as the private sector steps up to fill the gaps left behind by the state. The incertitude surrounding political decision-making would vanish, fostering an environment where investments flourish.

But how would this transformation play out in practice? Grimm didn't delve too deeply into specific examples, but she did touch on a few notable instances where private industry has trumped government intervention. For instance, in areas such as renewable energy and tech startups, it's evident that nimble, adaptive, and forward-thinking private enterprises often progress beyond what slow-moving bureaucracies can offer.

In essence, Grimm's argument is that the market, left to its own devices, will more efficiently guide the allocation of resources. With its inherited ability to react swiftly and nimbly, the private sector is well-suited to navigate a constantly shifting landscape, making it the natural choice for driving growth and innovation.

As for the potential drawbacks of her proposed concept, those are hotly debated among economists. Critics argue that a minimalist government can lead to underinvestment in certain areas, such as infrastructure and education, that are crucial for national development.

Nonetheless, Grimm's views represent an interesting challenge to traditional economic thought. Her call for a smaller role for the government in certain areas could soon spark a lively debate among economists, policymakers, and business leaders alike. Time will tell whether her ideas will have a lasting impact on the realm of economic policy.

- Economist Veronika Grimm believes that a reduction in government's influence would lead to greater private investment, particularly in sectors such as renewable energy and tech startups.

- Grimm posits that the private sector, with its agility and foresight, is better equipped to navigate a rapidly changing landscape and drive growth and innovation.

- However, critics argue that minimal government could lead to underinvestment in critical areas like infrastructure and education, which are essential for national development.

- Grimm's perspective, advocating for a smaller government in certain areas, raises intriguing questions and could instigate a substantial debate among economists, policymakers, and business leaders.