Fauji Fertilizer interested in purchasing shares in PIA

*Taking Flight: Fauji Fertilizer's Bold Leap into Aviation World with PIA on the Horizon*

Pakistan's corporate scene just got a dash of excitement as Fauji Fertilizer Company Limited (FFC) announced its intent to dip its toes in the aviation sector by potentially acquiring shares in the country's flag carrier, Pakistan International Airlines Corporation Limited (PIACL)!

Making waves at the Pakistan Stock Exchange (PSX), FFC's Board of Directors recently greenlit the submission of an Expression of Interest (EOI) and prequalification documents to the Privatization Commission of Pakistan. This bold move demonstrates FFC's expanding ambition to join the ongoing privatization fray, particularly focusing on struggling state-owned enterprises—with PIA at the forefront.

The Board also approved a whirlwind due diligence expedition to get a clear lay of the land and scope out PIACL's financial, operational, and legal health before making any investment commitments. The official disclosure, signed and filed by Brig Khurram Shahzada (Retd), FFC's Company Secretary, adheres to Sections 96 and 131 of the Securities Act, 2015, and Clause 5.6.1 of the PSX Rule Book.

The New Kid on the Runway: FFC's Cross-Sector Diversification

This thrilling crossover between agro-sector giants and the aviation industry could set a trailblazing example for other corporations to tread similar paths. If FFC seizes the opportunity, it'll be a rare feat, shaking up business as usual and igniting a contagion of corporate innovation.

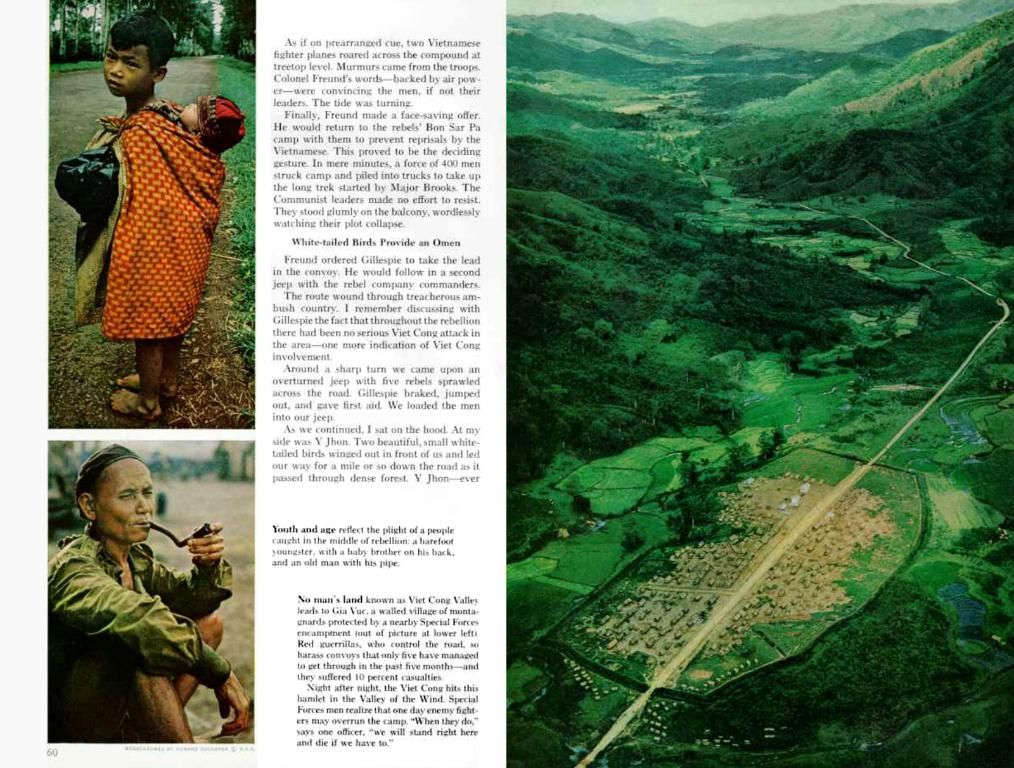

This development forms part of the federal government's relentless drive to offload loss-making state-owned enterprises under its broader economic restructuring strategy. Stuck with mountains of debt, operational inefficiencies, and crippling financial losses, PIACL has loitered on the privatization list for eons.

In the past, privatization attempts haven't gone swimmingly. In late 2024, one attempt crumbled after receiving unimpressive bids barely surpassing Rs?10 billion—far cry from the government's reserve price of Rs?85 billion. Waning investor confidence stemmed from PIACL's financial straits, a sharp 18 percent sales tax on new aircraft, and a lack of watertight financial safeguards. The bitter pie cost taxpayers a hefty $4.3 million in consultants' fees, compelling the government to rethink its approach before rebooting the privatization process in early 2025.

Boarding the Privatization Express: GST Exemptions on Aircraft Import and Lease

Eager to recoup its losses and get a fresh start, the federal budget for 2025-26 introduced GST exemptions for aircraft imports and leases, backdated to March 19, 2015. The sweetening deal covers whole aircraft (purchased or leased), spare parts, maintenance kits, simulators, engines, and key Maintenance, Repair, and Overhaul (MRO) equipment. The goal? Lighten PIACL's financial burden, boost operational efficiency, and, ultimately, heighten appeal for potential investors.

Market spectators optimistically propose that FFC's interest could serve as a much-needed catalyst for the privatization process, enticing additional institutional investors. According to AKD Securities, the government's decisive facelift of the national carrier, separating net liabilities of PKR 654 billion and non-core assets into PIA Holding Company Ltd. (Holdco), has transformed PIACL into a leaner, more attractive entity. Notably, the airline reported a positive EBITDA in CY24 and boasted an equity value of PKR 3.6 billion as of December 2024. Packing a financial wallop, FFC, with PKR 147 billion in cold, hard cash and short-term investments as of March 2025, has the financial muscle to carry out such negotiations.

Struggling Skyward: PIACL's Long History of Troubles

The government's decision to privatize PIACL stems from decades of financial woes, mismanagement, overstaffing, an aging fleet, and persistent operational hurdles.

Copyright Business Recorder, 2025

Sources:[1] Privatization Commission announces revised schedule for submission of PIACL’s pre-qualification documents, Business Recorder, Jun 12, 2025.[2] Fauji Fertilizer Company (FFC) validates bid for Pakistan International Airlines, ProPakistani, Jun 13, 2025.[3] The News, Fauji Fertilizer submits expression of interest for acquiring the shares of PIA, Business Recorder, Jun 14, 2025.

- FFC's planned investment in Pakistan International Airlines Corporation Limited (PIACL) is demonstrating a significant move towards diversification in the finance, business, and industry sectors.

- With the potential acquisition of PIACL shares, FFC's interests expand beyond the traditional fertilizer market, showcasing a momentum of value-driven investments, even in struggling state-owned enterprises.

- The due diligence process will help FFC evaluate PIACL's assets, liabilities, and debt to ensure a sound investment, as well as address operational and financial concerns.

- Should the privatization of PIACL proceed, a reduction in debt, improved operational efficiency, and increased equity value could entice other institutional investors to follow FFC's footsteps.

- The ongoing privatization of PIACL, embroiled in financial struggles for years due to mismanagement and operational inefficiencies, reflects the government's attempts to revitalize the finance sector and attract more investments in the economy.