Financial Management: Striking a Balance Between Investment and Family Spending

Balancing Family Budget and Investments: A Guide

Dealing with household expenses while also planning for the future can be tricky. It's common to feel overwhelmed when everyday expenses seem to consume most of your income. But fear not! With some strategic financial planning, you can strike a balance between taking care of your family's immediate needs and preparing for long-term goals. Here's a practical, no-nonsense guide to help you achieve peace of mind.

Get to Know Your Finances

- Track Your Cash: The key to balancing your budget starts with understanding your financial situation. Monitor all sources of income and categorize your expenses. Utilize budgeting tools or apps to visualize where your money flows each month.

- Prioritize Your Spending: Distinguish between essentials and non-essentials. Prioritize necessities such as housing, utilities, groceries, healthcare, and transportation. Invest any remaining funds wisely.

Create a Balanced Budget

- Set Financial Goals: Whether it's building an emergency fund, paying off debt, or saving for retirement, establishing clear goals provides direction for your budget.

- Craft a Realistic Budget: Base your budget on your financial tracking. Ensure it includes allocations for savings and investments. The 50/30/20 rule is a popular strategy: 50% for essentials, 30% for discretionary spending, and 20% for savings and debt repayment. Adjust these percentages to suit your unique situation.

- Build an Emergency Fund: Aim to save at least three to six months' worth of living expenses. This critical safety net covers unexpected expenses, preventing you from dipping into investment accounts.

Smarter Investing

- Begin Small: Investing doesn't require a large sum. Start with small, regular contributions. Over time, even small contributions can grow significantly due to compound interest.

- Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk. A diversified portfolio is less vulnerable to significant losses across the board.

- Max Out Employer-Sponsored Plans: If offered, take advantage of employer-sponsored retirement plans like a 401(k). Contribute as much as necessary to receive the full employer match. Explore other tax-advantaged accounts, like IRAs or 529 plans for education savings.

- Study Up: Investing can be complex, but plenty of resources are available to help you make informed decisions. Books, online courses, financial blogs, and videos can give you valuable insights into investment strategies and market trends.

- Collaborate with a Pro: If you're unsure about investing or where to start, consider consulting a financial advisor. A professional can help create a personalized investment strategy based on your financial goals, risk tolerance, and time horizon.

Manage Family Expenses Efficiently

- Cut the Fat: Regularly review expenses to locate areas where you can cut back. Small adjustments, like cooking at home instead of dining out or canceling unused subscriptions, help save money for savings and investments.

- Team Up: Embrace the power of family teamwork. Teach children about budgeting, and engage them in money-saving activities. This fosters a shared sense of responsibility and financial awareness.

- Plan Ahead: Anticipate significant expenses, such as vacations or home repairs. Set aside a portion of each month's budget for anticipated expenses to prevent financial strain.

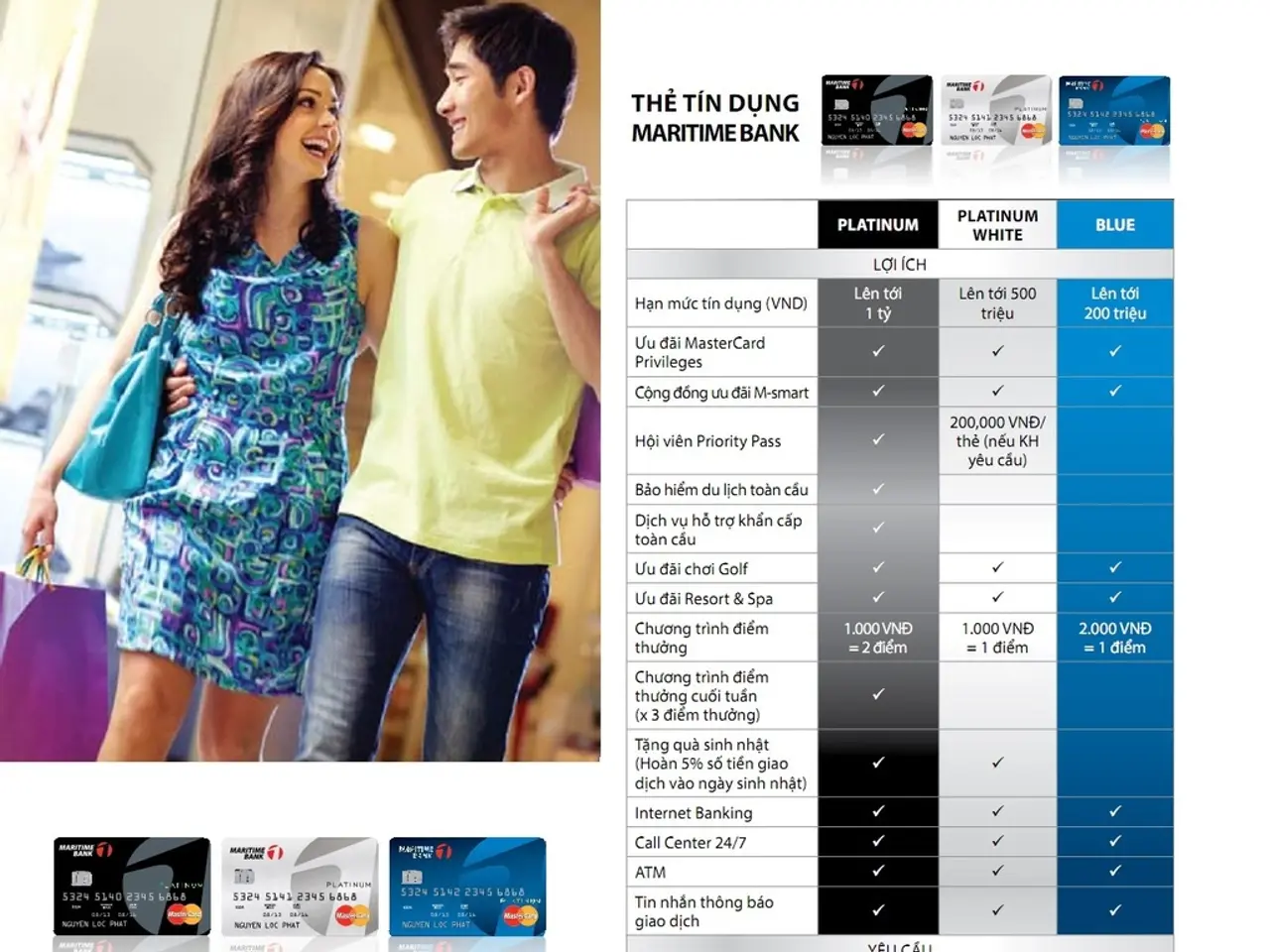

- Use Credit Responsibly: While credit cards provide convenience, avoid careless spending. Pay off your balance in full each month to avoid interest charges, and prioritize paying off existing debt to reduce financial stress and free up funds for investing.

A Balanced Budget: An Ongoing Process

Balancing personal finances involves regular review and adjustment, as circumstances, income levels, and financial goals can change. By tracking your income and expenses, setting clear financial goals, making informed investment decisions, and maintaining a proactive approach, you can manage your family's finances effectively and build a secure financial future.

- To ensure long-term financial security, it's crucial to invest the remaining funds wisely after prioritizing necessities, such as saving for retirement and building an emergency fund.

- By maintaining a well-diversified investment portfolio and setting aside funds for anticipated family expenses, one can strike a balance between managing immediate needs and preparing for the future in personal finance.