Stashed Fortunes Under the Pillows: The Persistent Increase in Cash Circulation

- *

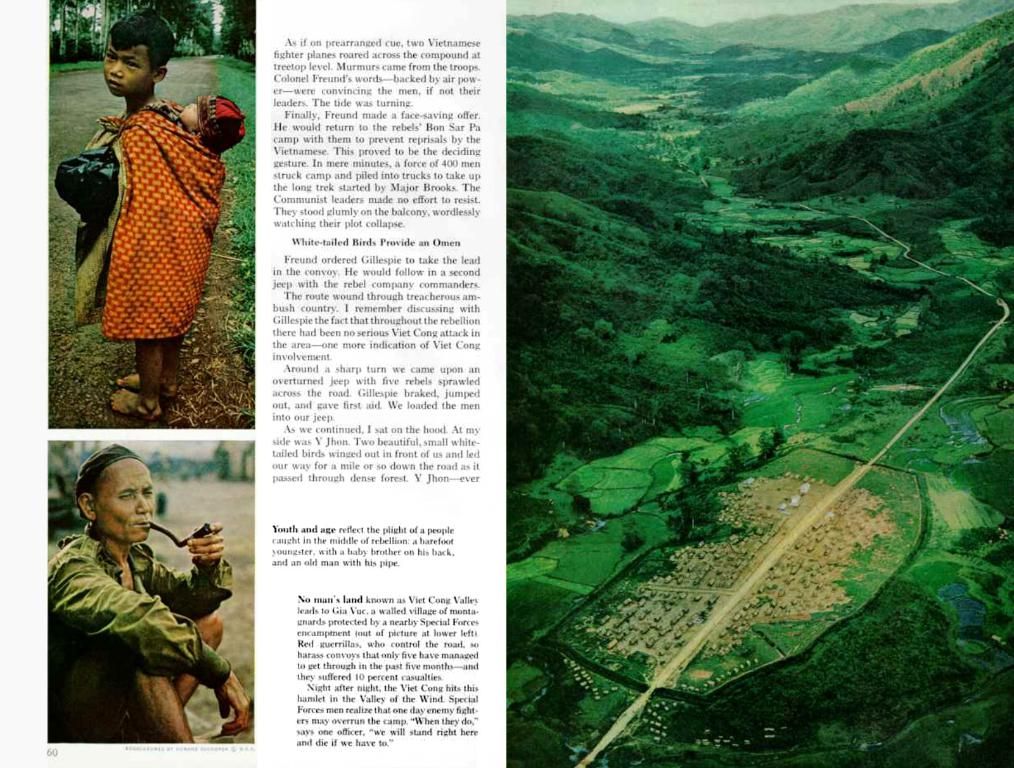

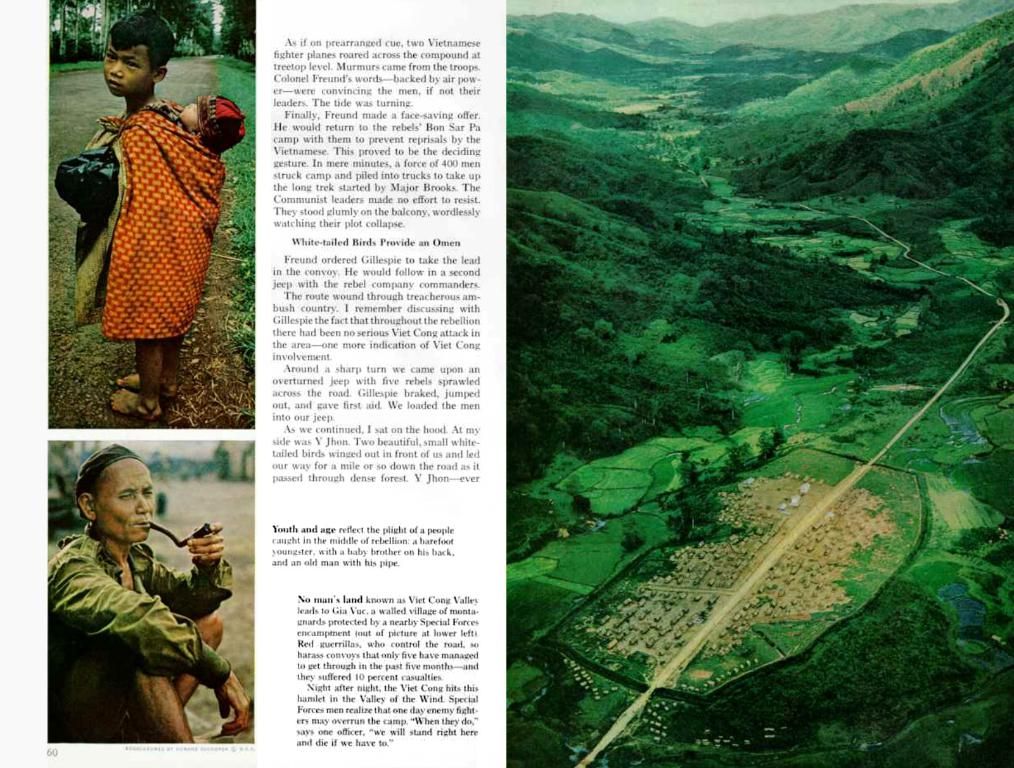

Under-the-mattress hoardings: The accumulation of currency remains on the ascendancy - Illicit Cash Hoardings Persist: Unreported Financial Reserves Keep Climbing Up

Contrary to popular predictions, cash isn't on the brink of extinction: Despite the dwindling significance of cash in daily purchases, the amount of banknotes and coins circulating in the eurozone continues to climb. Central banks and experts hypothesize that cash worth hundreds of billions is not being spent but stashed away.

Estimate: over 400 billion euros in cash sitting at home

According to Bundesbank data, the proportion of notes kept for "value storage" in Germany is approximately 42 percent, almost double the rate from 2013. In raw terms: By 2024, the Bundesbank predicts that 395 billion euros would be stored in German households - unevenly distributed, as surveys suggest that many households have little to no cash savings.

The "Cash Conundrum"

In March, according to European Central Bank figures, there were 1.564 trillion euros in circulation in the eurozone. This was around 30 billion more than in the spring of 2022 and 300 billion euros more than at the start of the coronavirus pandemic five years prior. While the growth rate has significantly slowed since 2022, the amount of cash in circulation continues to rise, not decrease. The Bundesbank refers to this phenomenon as the "banknote paradox." This trend has been observed "for many years, and in many countries," claims a Bundesbank spokesperson in Frankfurt.

"Even in 2021, the growth rate of banknotes in circulation consistently exceeded the annual inflation rate multiple times," says Johannes Gärtner, a payment expert at the consulting firm Strategy&.

The paradoxical nature of this trend is perplexing, as it is widely acknowledged that the number of people using physical cash is decreasing. In 2023, according to the Bundesbank, half of all point-of-sale transactions in Germany were still conducted in cash, but they accounted for only a quarter of total turnover.

Electronic payment picking up speed

According to a recent Strategy& survey of 5,500 respondents in ten European countries and Turkey, the debit card has surpassed cash as the most popular payment method - only 23 percent preferred to pay in cash. Many retailers also increasingly favor electronic payments, particularly contactless payments, which allow customers to make transactions without entering a PIN number. "This can be up to seven times faster than a cash transaction," says Bernd Ohlmann, spokesperson for the Bavarian Retail Association.

"Uncertainty fuels the trend"

However, why is more cash in circulation when fewer people use it daily? "The euro is being hoarded extensively," says Ralf Wintergerst, CEO of the Munich-based banknote and security technology manufacturer Giesecke+Devrient. "The production volume of the euro is also used for transactions, but it is now also being stored." The company has been in discussions with central banks for decades: "What happens in the cash cycle, why, and for what purposes is cash being used?" Wintergerst's explanation for the prominent trend of cash hoarding: "Uncertainty is the driving factor."

According to the Bundesbank, the share of cash held for preservation of value peaked at 43 percent during the COVID-19 pandemic, predominantly due to extended lockdowns at the onset of the crisis. "The increase in banknote circulation during crises, not just during the COVID-19 pandemic, due to the uncertainty they bring is a well-documented phenomenon," said a Bundesbank spokesperson.

Cash reigns supreme in the underworld

Business consultant Gaertner provides two additional factors that likely contributed to the increase in cash circulation. "In general, the growth in cash is not linked to standard payment transactions," said the financial expert. "The reasons lie in a mix of 'hoarding,' shadow economy, and its role as a reserve currency abroad." The shadow economy encompasses economic activities that operate outside the law, ranging from tax evasion to criminal activities. For instance, the A3 motorway in Bavaria is notorious for police finding large sums of cash during checks: In November, customs officers discovered one million euros in a 34-year-old man's car, allegedly from illicit activities and packaged in plastic bags.

Old-school but secure

Despite cash losing relevance in the lives of law-abiding citizens, it is not anticipated that only criminals will carry banknotes and coins in the future. The Bundesbank is committed to maintaining cash and its infrastructure. Cash offers undeniable advantages, including not requiring electricity or electronic infrastructure. "The central bank must ensure a sustainable, resilient payment infrastructure," said G+D CEO Wintergerst. "If there's war, if there are crises, during floods, it must still be possible to pay. That's what cash is for."

- German Federal Bank

- Omen

- Mattress

- Germany

- Frankfurt

- Coronavirus

- Ralf Wintergerst

- Munich

- Bavaria

- ECB

- Spring

- Consulting firm

Backstage:

In addition to the decline in physical cash usage, several factors contribute to the enduring increase in cash circulation:

- Safety and Emergency Purposes: People often save cash as an emergency fund or for unexpected situations, particularly during times of economic instability or concern about privacy.

- Shadow Economy: Cash remains popular in the illicit economy, where transactions are unreported to authorities. This may contribute to heightened demand for cash.

- Global Tourism and International Transactions: The euro is a widely-used currency worldwide, and tourists exchange their currency for euros. Additionally, international transactions, legal and illegal, can drive cash demand.

- Inflation and Economic Uncertainty: During periods of high inflation or economic uncertainty, people may prefer to hoard cash as a store of value to avoid losing purchasing power.

- Lack of Negative Interest Rates for Individuals: Unlike institutions, individuals are generally exempt from negative interest rates on cash holdings, making it less costly for them to hold cash.

- Technological Lags: While digital payment systems are becoming more prevalent, there are still regions and demographics where cash remains the only viable option, contributing to its continuous circulation.

The rise in the money supply, such as the M2 money supply in the eurozone, which includes cash, deposits, and other liquid assets, reflects broader economic conditions and monetary policy decisions. However, the specific increase in cash circulation is more closely tied to behavioral and economic factors than to overall money supply metrics. In short, while cash is declining in everyday transactions, its continued surge is influenced by factors beyond retail usage, including economic habits, global usage, and the illicit economy.

- While electronic payments are increasing in popularity, the German Federal Bank estimates that over 395 billion euros will be stored in German households by 2024, due to the safe and emergency purposes that cash serves, especially during times of economic uncertainty or privacy concerns.

- The enduring increase in cash circulation is not only attributed to the decline in physical cash usage, but also to the popularity of cash in the illicit economy, global tourism and international transactions, high inflation or economic uncertainty, lack of negative interest rates for individuals, and technological lags in certain regions and demographics.