Middle East escalation takes toll on Dow & Co, while Chevron, Oracle, Tesla, Palantir post gains

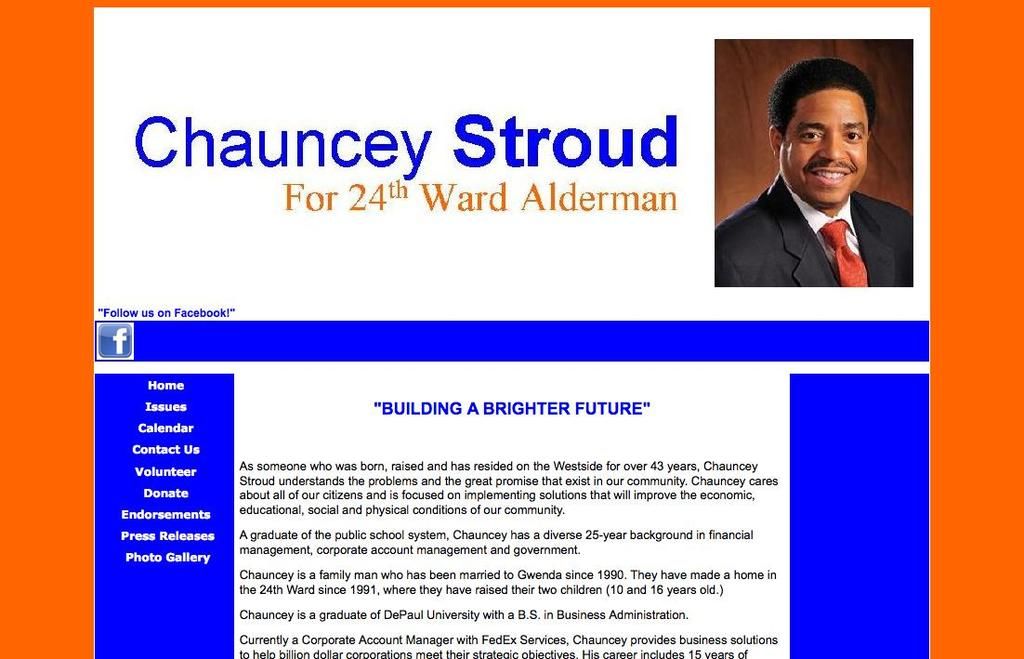

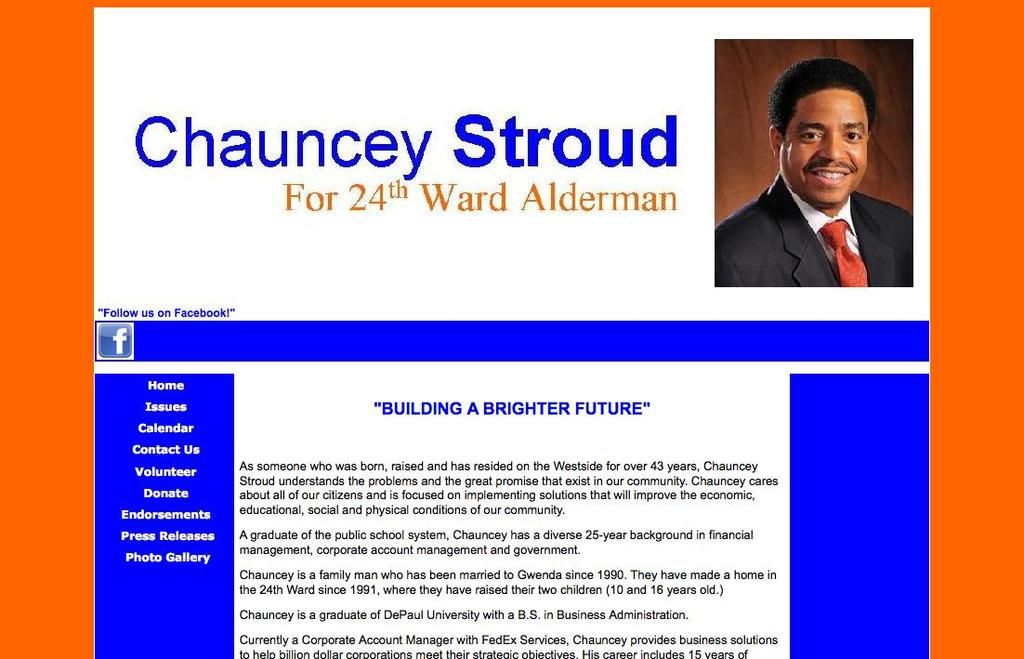

Revised article:

A tense Middle East escalation hurts US stocks, but tech giants stand out

Let's dive into the rollercoaster ride that was Wall Street today. The Middle East crisis took a turn for the worse, with Iran retaliating against Israel's bombing of nuclear facilities and military targets, causing a 1.8% downturn in the Dow, a 1.1% slide in the S&P 500, and a 1.3% drop in the Nasdaq.

But not all was gloom and doom. The University of Michigan's consumer sentiment index for June came out better than anticipated, yet its positive impact was not felt in the current uneasy geopolitical climate. Despite the ongoing chaos in the Middle East, there were a couple of winners in the Dow Jones: Chevron with a 0.7% gain and Johnson & Johnson with a 0.3% increase.

At the bottom of the Dow, we found Sherwin-Williams losing 5.7%, Visa down 5.0%, and Nike slipping 3.6%.

Looking at the Dow

Oracle's stock was once again on fire, with shares emerging as the top gainers in the S&P 500 yesterday, jumping over 13%. That momentum carried over, and Oracle closed the day with a 7.7% rise, setting a new all-time high of $216.60.

In the Nasdaq 100, Diamondback Energy topped the charts, ending the day up 3.7%, followed by Tesla with a 1.9% gain and Palantir with a 1.6% rise. At the bottom of the Nasdaq 100, PayPal and Adobe shed over 5%, while AppLovin rounded off the list of weakest stocks with a 4.2% loss.

A beacon in a storm

It seems the geopolitical situation in the Middle East, with the ongoing conflict between Israel and Iran, is affecting global markets substantially. The energy market is especially vulnerable, with the Middle East being a critical player in global energy supplies. Disruptions in oil supply chains can lead to price increases, which in turn impact inflation and economic growth.

Despite the volatility, strategic investors are encouraged to diversify across regions and asset classes to minimize the risks associated with the Middle Eastern turmoil. In these turbulent times, stocks like Oracle, Tesla, and Palantir are proving to be beacons of light in the storm.

Material sourced from dpa-AFX

Enrichment Data Insights Integration:

- While the Dow Jones was down as a whole, Oracle and Johnson & Johnson showed resilience amidst the chaos.

- The Middle East conflict's wider implications extend beyond its oil reserves, with the region facing challenges such as high public debt, severe inflation, and high poverty levels, worsened by sanctions, conflicts, and governance failures.

- Strategic investors would be wise to diversify their portfolios across regions and asset classes to limit their exposure to Middle Eastern geopolitical volatility and its potential repercussions on energy prices and economic stability. *End of User Input*

- Strategic investors may find opportunities in resilient companies like Oracle and Johnson & Johnson, despite the downturn in the Dow Jones, as they have demonstrated strong performance in the current geopolitical climate.

- To limit exposure to Middle Eastern geopolitical volatility and its potential effects on energy prices and economic stability, diversifying portfolios across regions and asset classes is advisable, especially considering the challenges faced by the region, such as high public debt, significant inflation, and high poverty levels exacerbated by sanctions, conflicts, and governance failures.