Aging Population: Baby Boomers Struggle to Leave Workforce Early

- *

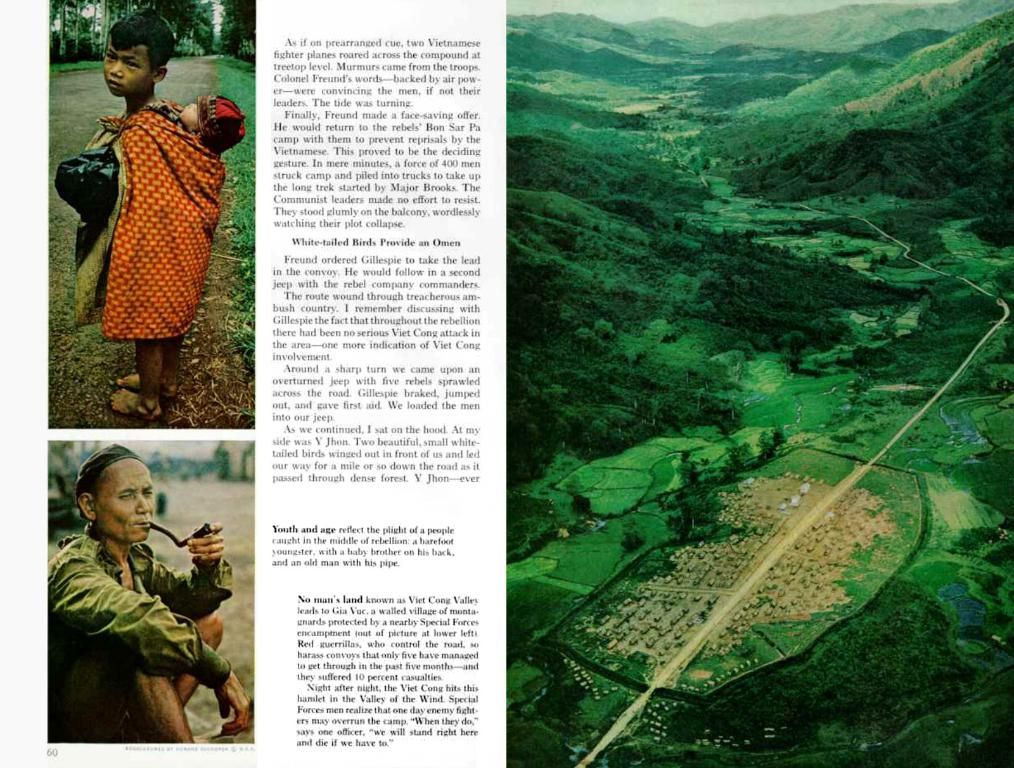

Ballpark figure of numerous baby boomers retiring ahead of schedule - Multitudes of baby boomers opt for early retirement.

Rather than retiring early, many Baby Boomers in Germany are finding themselves forced back into employment due to insufficient retirement savings. According to a new study by the Institute of the German Economy (IW), it's estimated that roughly 1.8 million Baby Boomers who had reached retirement age by 2023 have continued working. This equates to 44% of all Baby Boomers in the respective birth cohorts and 55% of new retirees, as per pension insurance data.

If this trend persists, the IW study predicts that at least one million Baby Boomers will retire annually from 2025 onwards, before reaching the standard retirement age. The rise in the statutory retirement age to 67 is not expected to significantly impact the average age of retirement.

The primary obstacle for Baby Boomers leaving the workforce early is the pension system, according to the employer-friendly IW. Retirees with long-term insurance are entitled to receive a pension without deductions after 45 years of employment.

Retiring Without Deductions?

Study author Ruth Maria Schuler suggests that the Union and SPD should limit the options for early retirement for long-standing insured individuals. However, limiting these options was a core campaign promise of the SPD and is also promised in the coalition agreement.

Federal Politics: An Overview

Subscribe to our free capital newsletter - and stay informed on the crucial information curated by our expert Berlin politics team!

For years, it has been apparent that the impending wave of Baby Boomers would lead to additional expenses for the pension fund, while the number of contributors may decrease. Given this grim outlook, Federal Chancellor Friedrich Merz (CDU) announced the formation of a "Pension Reform Commission" in the Bundestag. Although this commission has not yet been formed, it's expected to deliver results in the middle of the legislative period, as per the coalition agreement[3].

The pension fund is experiencing cost pressure, as pension expenses are expected to double by 2045, from the current 372 billion euros. The expenses will increase even more if the pension level, which is promised by black-red, is maintained at 48%[3].

Who Typically Retires Early?

Despite the demographic challenges, former labor minister Hubertus Heil had previously rejected calls for longer working hours or exceptions for early retirement without deductions due to health concerns. The current minister, Barbara Bas (both SPD), recently stated in an interview that certain professions may require workers to retire by 60 years of age.

Schüler points out that long-term insured individuals who retire without deductions tend to have higher household incomes and better education. These individuals are not typically engaged in physically demanding labor.

A study by the ifo Institute revealed that the deduction-free pension is primarily utilized by males, skilled workers, and individuals with recognized vocational qualifications[2]. According to an earlier IW survey, lower wage groups often have to forgo early retirement due to financial reason.[3] Schüler explains that in the case of the deduction-free pension, you will often find industrial professions and traditional skilled worker careers.

Making Work in Old Age More Attractive

"The goal of politics should be to maintain the baby boomer generations in the workforce for as long as possible in order to smooth out the demographic wave," says the IW in its current study. In fact, both the SPD and the Union wish older individuals to remain professionally active for as long as possible and are supportive of the concept of an "active pension," where those who reach the statutory retirement age and voluntarily continue to work will receive their income up to €2,000 per month tax-free[4].

Schüler encourages the black-red coalition to discuss certain restrictions on early pension access in the announced pension commission. Needless to say, those who are approaching retirement age after many years of work will likely face much to consider.[4]

Federal Government: "Retirement at 63" Coalition Agreement, Federal Ministry of Labour and Social Affairs, Pension for (especially) long-standing insured persons, Interview Baerbel Bas, IW, Demographic Change, SPD, Coalition Agreement, Berlin, Institute of the German Economy, German Press Agency

[1]: Early Start Pension Plan for Gen Alpha: An Innovative Approach to Future Retirement Challenges[2]: Ifo Institute Study: Deduction-Free Pension Mainly Benefits Skilled Workers[3]: Federal Chancellor Announces Pension Reform Commission to Address Mounting Expenses and Decreasing Contributors[4]: "Active Pension" and Keeping Older Workers in the Workforce: Proposed Reforms by SPD and UnionPolitics, Finance, Pension System, Baby Boomers, labor force, retirement, demographics, pensions, early retirement, working in old age, poverty, Ifo Institute, SPD, Federal Chancellor Friedrich Merz, Coalition Agreement, Pension Reform Commission, Federa government pension policy, active pension, labor force participation.

- The study by the Institute of the German Economy (IW) suggests that the Union and SPD should limit the options for early retirement for long-standing insured individuals due to the rising expenses of the pension fund and the decreasing number of contributors.

- Schüler, the study author, explains that long-term insured individuals who retire without deductions often have higher household incomes and better education, and typically are not engaged in physically demanding labor.

- The SPD and the Union support the concept of an "active pension," where those who reach the statutory retirement age and voluntarily continue to work will receive their income up to €2,000 per month tax-free, with the goal of keeping Baby Boomers in the workforce for as long as possible to offset the effects of demographic change.