National Express owner gets demoted from FTSE 250, as Wickes takes its place in the index

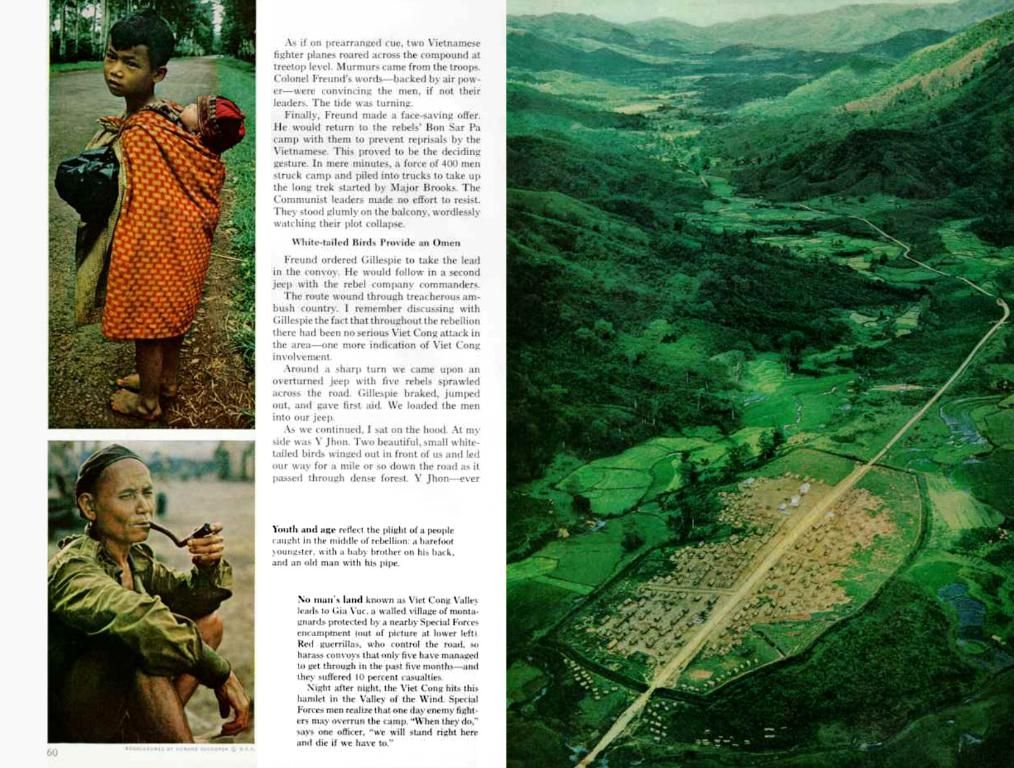

Wickes Gains Prominence, Others Fall:

The London Stock Exchange is shake-up time, with Wickes set to star in the FTSE 250, while some big players like Mobico, National Express' owner, and Ferrexpo are at risk of being ousted.

Wickes' stock price surge of 35% in the past three months has earned it a spot in the grander arena. With a £20m share buyback program and a boost in big-ticket sales recovery, it's all systems go for Wickes. Joining the FTSE 250 roster is Gamma Communications, moving from the LSE's junior AIM market, despite a 9% drop in shares over the same period.

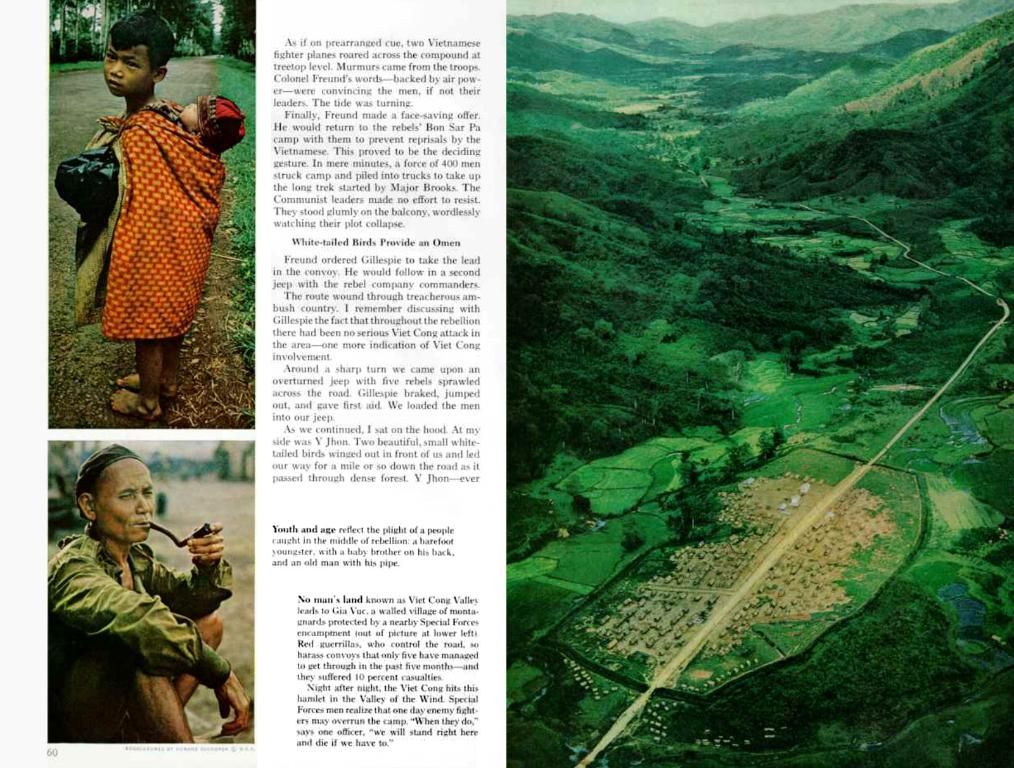

Two investment trusts, Ashoka India Equity Investment Trust and Pantheon Infrastructure, are also set to join the FTSE 250 after a 10% share price increase in the last three months.

Come June 20th, these changes will take effect.

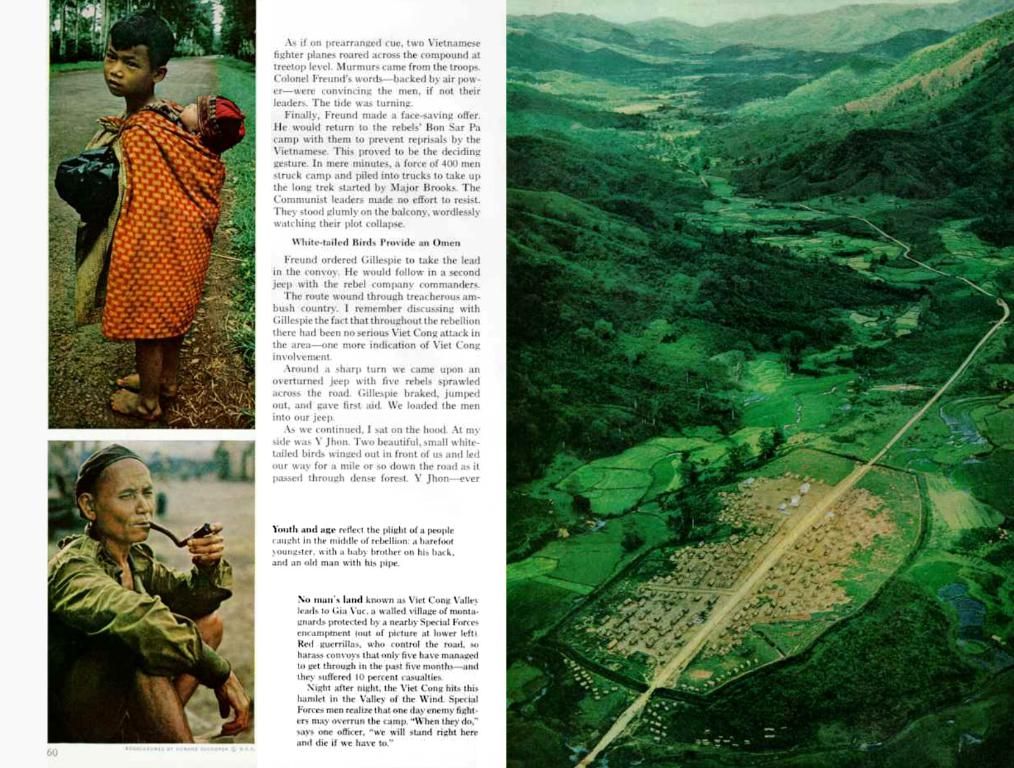

FTSE 250 Exits:

Wickes isn't the only story here. Firms like Mobico, Ferrexpo, and Bellevue Healthcare Trust are heading south, falling to the FTSE Smallcap index.

Mobico, originally stationed well above the FTSE 250 cut-off, took a hit due to its North American school bus business sale announcement in April for less than expected. This sent shares plummeting. Bellevue Healthcare Trust, plagued by investor withdrawals, has shrunk significantly, pushing it into the Smallcap arena.

Embattled mining firm Ferrexpo found itself out of the index due to legal battles and issues surrounding its Ukrainian subsidiary.

No alterations were made to the FTSE 100.

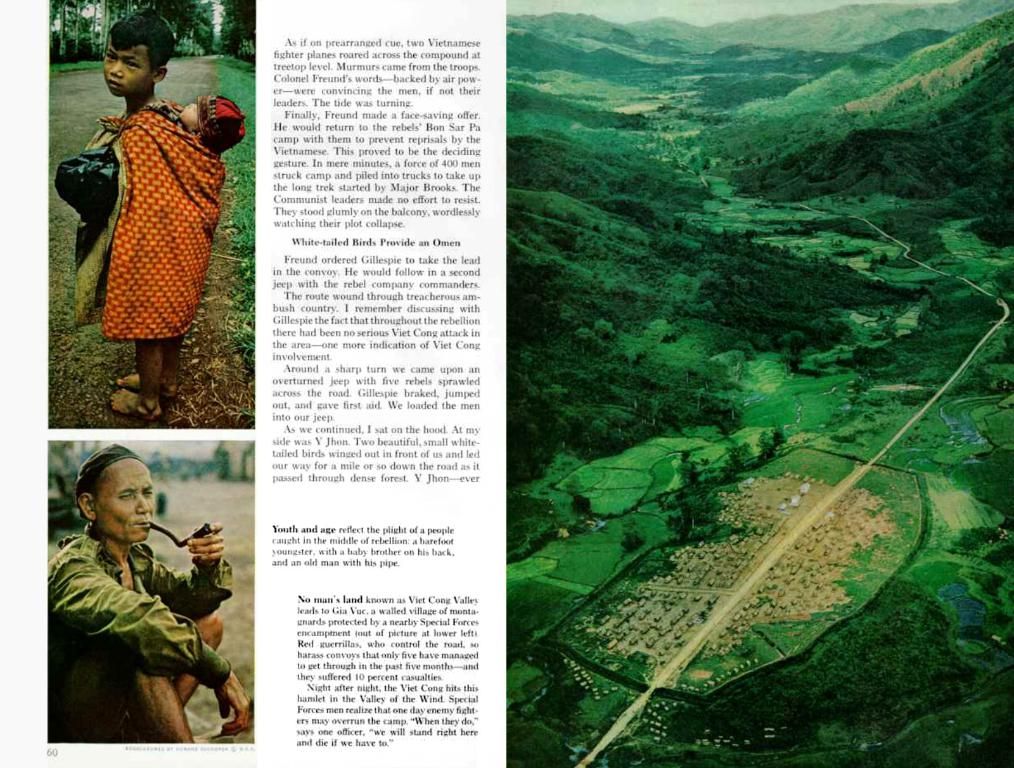

More Moves Below the Radar:

Analyst Ewan Lovett-Turner pointed out that the real action might be taking place in the FTSE Smallcap index, particularly for companies new to any index, such as the addition of Rockwood Strategic Investment Trust. He suggested that these newcomers could attract up to 10% of their share capital over time, but the timing of such buying can vary.

While movements in the FTSE 250 may appear less significant due to less tracking money, being part of the index tends to elevate companies on investors' radar.

In the light of Downturns for some, Wickes' rise signifies a shift in investing strategies within the business and finance landscape, as it prepares to join the FTSE 250 after a substantial stock-market surge. Conversely, firms like Mobico, Ferrexpo, and Bellevue Healthcare Trust are set to exit the FTSE 250 due to various reasons, finding refuge instead in the FTSE Smallcap index, potentially attracting notice from discriminating investors.