Dive Brief:

- Four Skechers board members have stepped down, according to a company statement and filings.

- The company asserted that the departures weren't due to disagreements about operations, strategy, or policies.

- Zulema Garcia, a senior vice president at Herbalife Nutrition, joined Skechers' board on the same day the resignations were announced. The departure of the directors follows a larger stake acquired by activist investors Tremblant Capital Group.

Dive Insight:

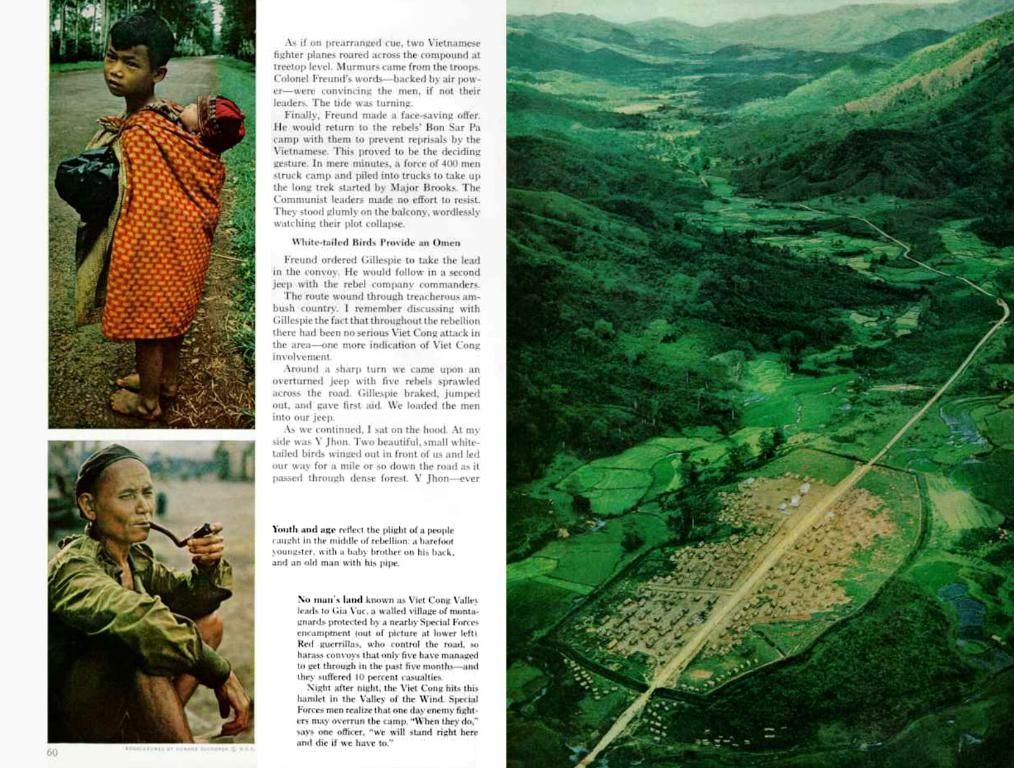

- The reasons for the departure of Jeffrey Greenberg, Geyer Kosinski, Richard Rappaport, and Tom Walsh remain undisclosed by Skechers. Greenberg, a member of the company's founding family, has been a board member since 2000 and serves as the senior vice president of active electronic media. These long-serving directors left the company less than a month after Tremblant Capital Group upped its stake in Skechers above 5%.

- In a letter to the company dated December 1, Tremblant highlighted its expectations. These included cash distributions to shareholders through dividends and an assertive stock buyback program. Tremblant also advocated for the elimination of Skechers' dual share class structure, which gives certain shares elevated voting rights and keeps the Greenberg family in control.

- Tremblant acknowledges Skechers' business success, with growth outpacing competitors over the past decade. However, it contends that the company's stock is underpriced compared to its performance. Share buybacks could explain this thesis, as they have historically been used to artificially inflate share prices.

- The practice of share buybacks became prominent in the 1980s and is a staple of modern business and economy. Its use in retail, including by Skechers, has risen, particularly after a temporary halt during the pandemic. Critics argue that buybacks prioritize short-term gains over innovation and employee investment.

- Outside analysts like B. Riley Securities view Skechers favorably. In a recent research note, they stated, "We remain positive on [Skechers] as the company has already surpassed 2019 sales levels despite supply chain challenges and international markets still grappling with COVID." They also believe that improved pricing and reduced promotions will boost Skechers' margins.

- With a revamped board and pressure from activist investors, Skechers could be in for a transformative year. If the company follows through on financial policy changes, it remains to be seen if its operational performance will continue as it has.

- The retail industry, including Skechers, has increasingly utilized share buybacks as a strategy, particularly after the pandemic, a practice that critics argue prioritizes short-term gains over innovation and employee investment.

- AI and finance research suggest that the use of share buybacks, a staple of modern business and economy, can artificially inflate share prices, making it a topic of interest for financial markets.

- The success of Skechers' business, with growth outpacing competitors over the past decade, has not been reflected in its stock price, according to Tremblant Capital Group. This perceived undervaluation could be a factor in their push for financial policy changes.

- The AI industry could play a significant role in the transformation of Skechers in the coming year, as outside analysts like B. Riley Securities predict improved pricing and reduced promotions, which could boost the company's margins.

Skechers undergoes reshuffling in its board of directors

The departure of Skechers' long-serving directors, including Jeffrey Greenberg, could signal a shift in the company's financial policies, as activist investors Tremblant Capital Group have advocated for cash distributions, a stock buyback program, and the elimination of the dual share class structure.