Surge in Insolvencies: Germany's Small Businesses Battle Decade-High Default Rates

Soaring bankruptcy rates in Germany reach critical point, causing financial strain.

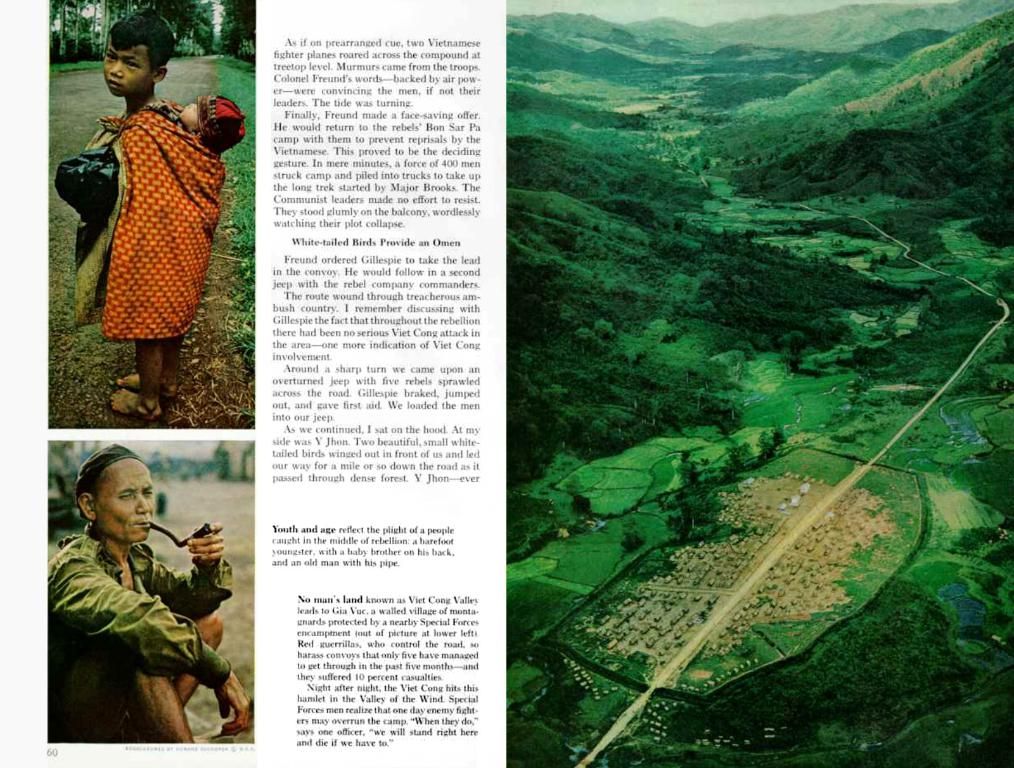

Germany's economy is buckling under the pressure, as the default rate for companies soars to its highest level in over a decade. The bleak outlook was revealed by Creditreform Rating, with the rate climbing from 1.49% to 1.78% last year and projected to exceed 2% in 2025 - a level last seen during the 2008 global financial crisis.

This disheartening report is a reflection of the economic hardships faced across the nation. "Current economic instability is primarily attributed to weak investment, entrenched industry issues, and external financial pressures, such as US tariffs," explains Benjamin Mohr, a member of Creditreform Rating's management board.

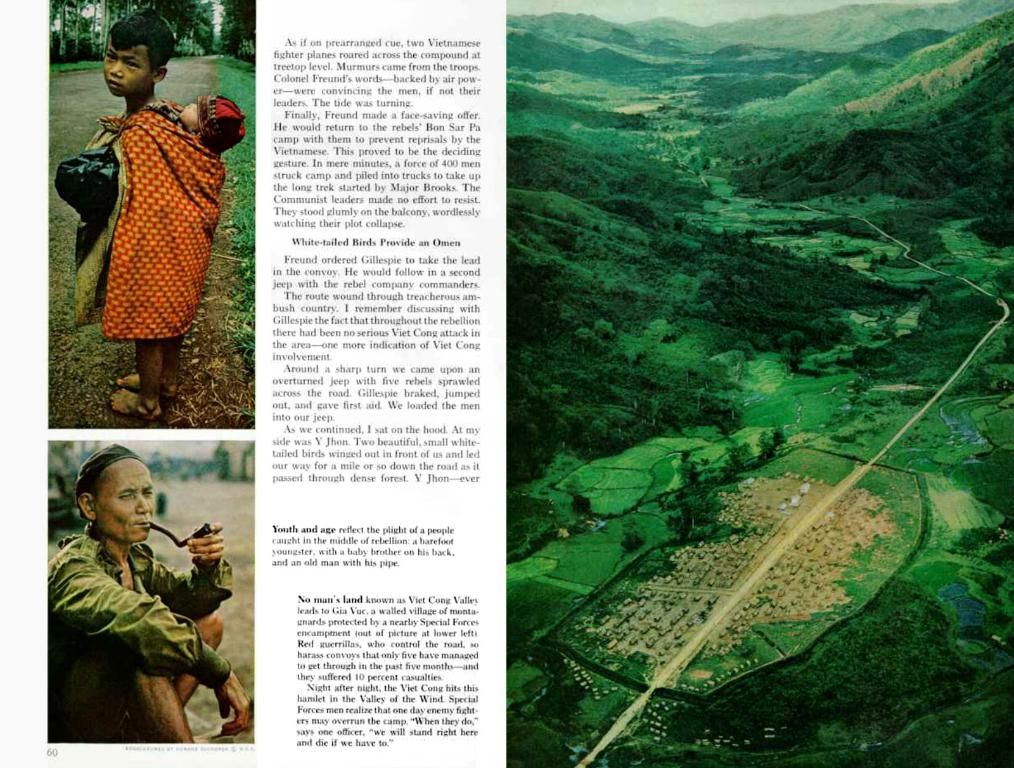

Young and Small Businesses Under Siege

While predictions suggest minimal growth for Germany's economy in 2025, the default rates are unlikely to decline – a worrying trend with no immediate relief in sight. "Short-term temporary remedies, such as decreasing inflation and cessation of interest rate hikes, have yet to be effective in checkmating the escalating threat of defaults," Mohr adds.

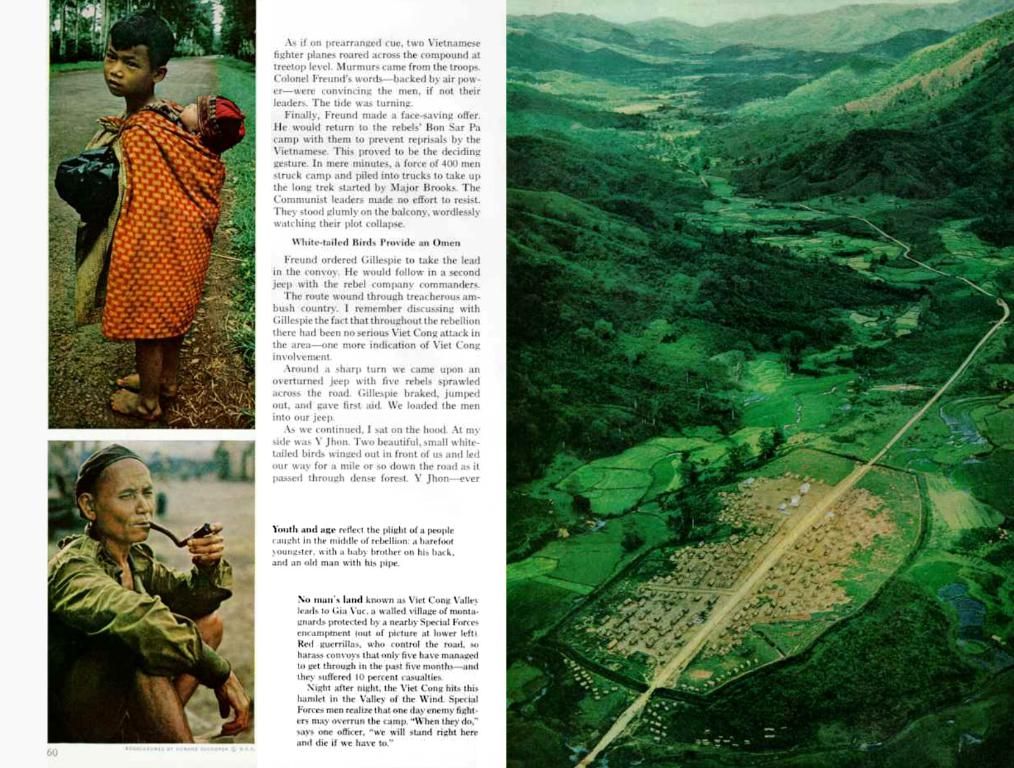

The brutal brunt of economic woes is being borne disproportionately by small businesses, specifically companies with annual turnover between 500,000 and 2 million euros. They endure an alarming 2% default rate, in stark contrast to the negligible 0.4% faced by multinational corporations with annual turnovers of at least 250 million euros.

The default rate is particularly high for youthful enterprises, with businesses between two and five years of age experiencing a sobering 3.66% default rate. Fortune seems to favor the wise, as companies with ten years or more of existence have a humbler rate of over 1%.

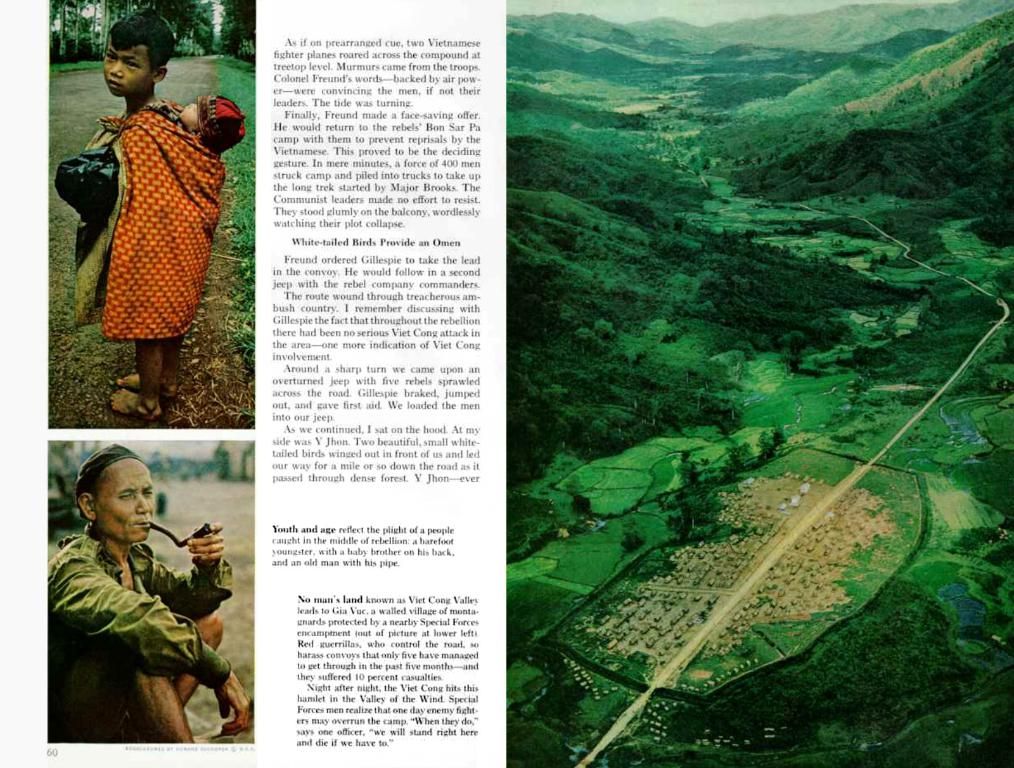

Hit List: Industries in Peril

The transportation and logistics sector is the hardest-hit, recording a default rate of 3.37%. It's closely followed by the beleaguered construction industry with a 2.30% default rate. The basic chemical industry, on the other hand, boasts an admirable default rate below one percent.

Economy: Gloom Instead of Growth

Germany's economy finds itself faltering, as it braces for stagnant growth rather than the anticipated resurgence. The persisting economic iron grip has proven dire for SMEs, many of which are now facing financial ruin. Stuck in a vicious cycle, companies are forced to make drastic cuts, with one in three planning to slash investments and up to 35% readying to trim their workforce.

As gloom enshrouds the economy, it's crucial to provide targeted support for SMEs and implement strategic policy interventions to kick-start the long-awaited economic recovery.

Sources: ntv.de, mbo

- Economic Trends

- Insolvency

- Economic Crisis

Insight: Facing a challenging economic period, Germany is grappling with the surge in insolvency rates among small and young businesses. This situation echoes past crises, like the 2008 financial crisis, albeit exacerbated by global trade uncertainties and a prolonged economic slump. Addressing these challenges requires targeted assistance for SMEs and proactive policymaking to stimulate economic revitalization.

Community policy needs to be enacted to provide targeted support for small businesses struggling with insolvency, as they face an unprecedented surge in default rates. Employment policy should also be considered, as small businesses are planning to slash investments and trim their workforce in response to the economic crisis. Additionally, financial policies should be implemented to mitigate the impact of default rates, which are particularly high for young businesses and industries such as transportation and logistics.