Solana Treasury Reserve Receives $500 Million Investment from Classover

In a bold and ambitious move, Classover Holdings Inc., a $63 million edtech powerhouse, has sealed a deal with Solana Growth Ventures LLC for up to $500 million in senior secured convertible notes. This funds will be used to reinforce Classover's Solana (SOL)-based treasury reserve, as the company navigates short-term liquidity issues.

With a current ratio of a mere 0.02, indicating a squeeze on working capital, Classover needed a lifeline, and Solana Growth Ventures provided it. The contract comes with an initial payment of $11 million, subject to meeting standard closing conditions.

The convertible notes can be transformed into Classover's Class B common stock at a price that doubles the closing price of the stock at the time of the deal. Interestingly, up to 80% of the funds raised will be invested in SOL tokens, solidifying Classover's commitment to its SOL treasury strategy.

Previously, Classover bought 6,472 SOL for around $1.05 million, and now, they're eyeing discounted locked tokens to beef up their reserves. This deal builds upon an earlier $400 million equity agreement, potentially giving Classover a whopping $900 million to pour into SOL.

Ms. Luo, the CEO, hailed the funding as a "significant milestone," indicating Classover's ambition to integrate Solana into its core finances. Chardan serves as the sole financial advisor and placement agent for this deal.

Launched in 2020, Classover offers live online classes for students worldwide. However, its revenues have dipped by 102% in the past year, signaling a need for a financial rebound. This funding round is a crucial step in that direction.

Moreover, Classover has announced a change in CFO Yanling Peng's salary structure, with an annual salary of $156,000 starting May 1, 2025. This move corresponds to changes in leadership and company strategy, suggesting confidence in securing a financially healthier future, including expanding its crypto-backed treasury.

This strategic decision to embed Solana as a core asset within its corporate treasury marks a pioneering step among publicly traded companies, leveraging Solana's potential long-term value and growth opportunities. By diversifying its corporate treasury beyond traditional fiat and equities, Classover aims to bolster Solana's reputation and attract more institutional investors, accelerating the integration of digital assets into mainstream corporate finance.

Also Read: Polkadot VC Fund CEO Max Rebol Offers a Firm Perspective on Solana

Classover Holdings Inc., a $63 million edtech powerhouse, has secured funds from Solana Growth Ventures LLC, which will largely be invested in SOL tokens, reinforcing Classover's commitment to its Solana (SOL)-based treasury strategy.

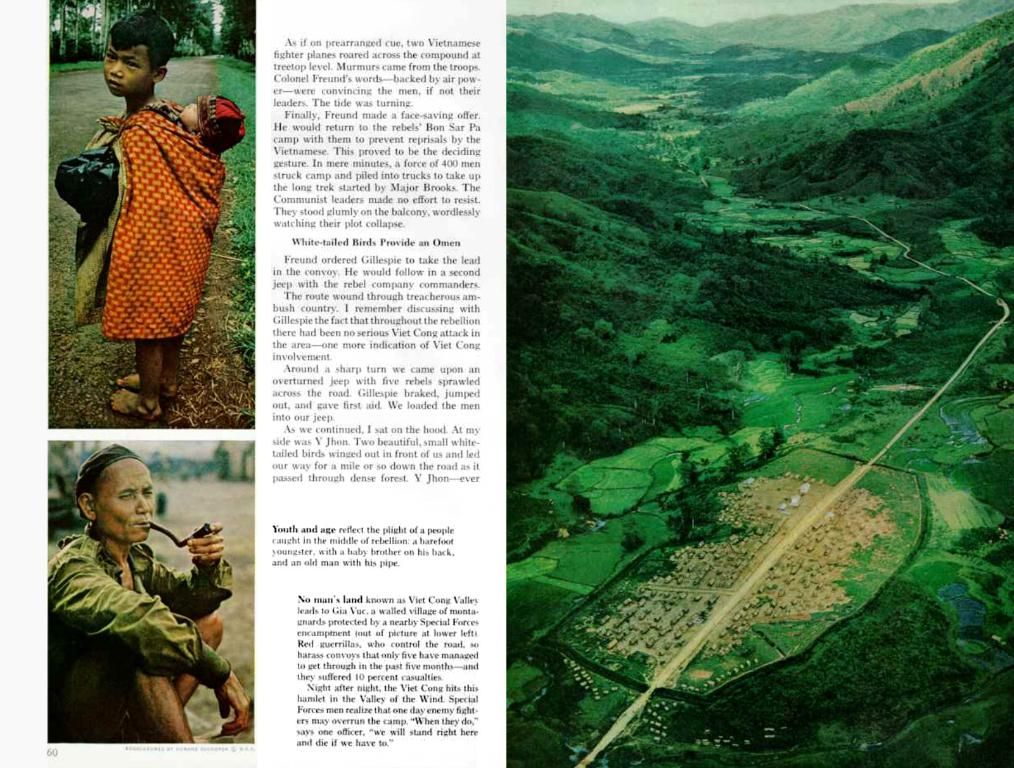

This funding round, potentially totaling $900 million, is a significant step for Classover as they aim to integrate Solana more deeply into their core finances, bobbing towards digital assets in mainstream corporate finance.