Sparkasse's Bank Fees: What You Should Know About Reclaiming Unfair Charges

Claiming Back Forbidden Bank Fees Permissible within a Three-Year Span (according to BGH) - Timeframe for Recovering Bank Fees Limit: 3 Years (BGH)

Here's a lowdown on the alleged unauthorized bank fees imposed by Berliner Sparkasse in 2016 and the current status of reclaiming those unfair charges, according to the Federal Court of Justice (BGH) rulings and the limitation period.

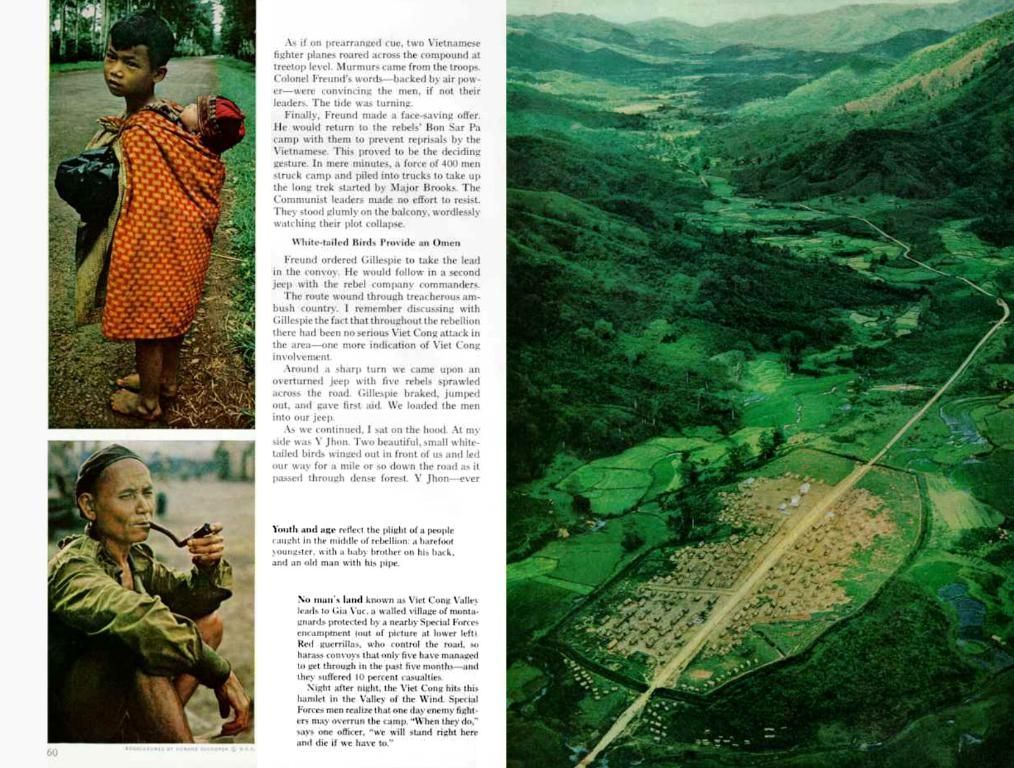

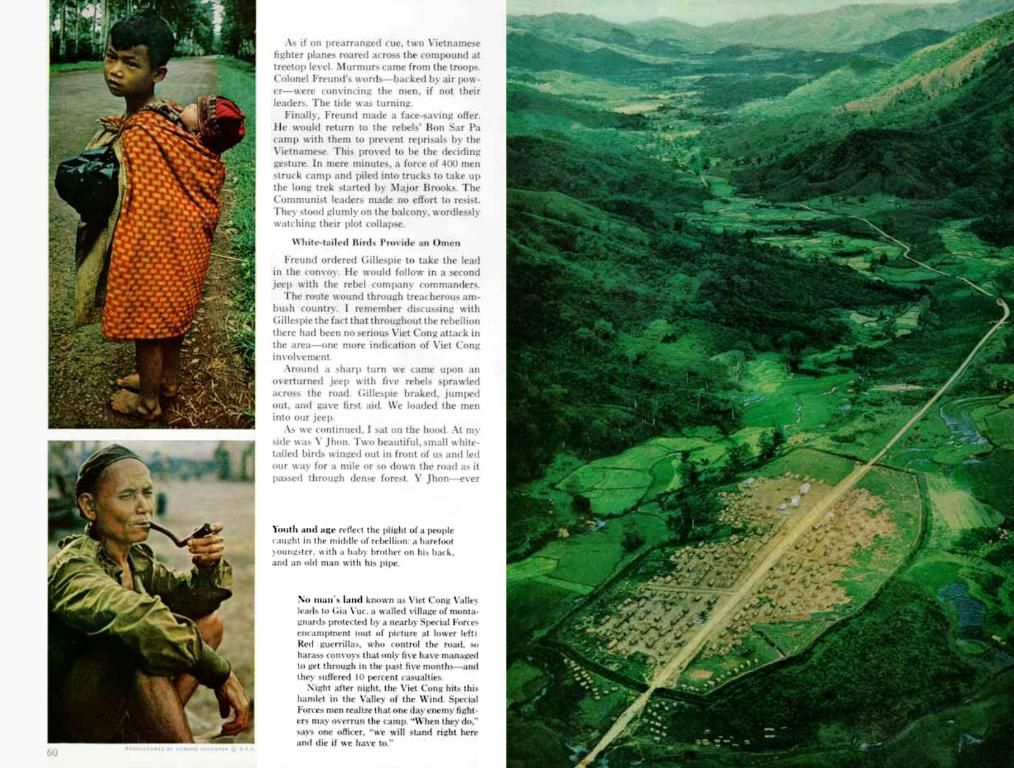

A tidal wave of customers joined a suit initiated by the consumer association vzbv against Berliner Sparkasse in 2019, after they slapped hidden charges on current accounts without obtaining explicit customer consent towards the end of 2016. The new fees hiked the account management costs by a few euros and even extinguished the free student account offer.

Fast forward to April 2021, the BGH declared that banks need explicit approval before scrapping free services or tweaking fees. This ruling, though related to another case, offers a general guideline for banks across Germany.

Post the BGH ruling, Berliner Sparkasse flip-flopped their approach. The vzbv filed a lawsuit to recover the misappropriated fees, and the Berlin Chamber Court sided with consumer advocates in March 2024, granting customers the right to reclaim unlawful charges. However, they deemed claims made before 2018 as outdated.

The vzbv appealed against this verdict to the BGH, arguing that the limitation period ought to start from the 2021 ruling, as customers were uninformed of their rights and couldn't file a claim earlier. The new ruling, hence, should extend until the end of 2024.

Regrettably, the BGH didn't toe this line of argument. They maintained that the legal landscape was neither murky nor uncertain before the 2021 ruling, and consumers could have raised a legal fuss then. Accordingly, they were granted three years from the year in which the infringement occurred to initiate a lawsuit.

Now, here's the twist – a study conducted by market research institute Innofact in May 2022, commissioned by comparison portal Verivox, found that only 11% of adults surveyed had claimed bank fees from their bank so far.

To delve deeper into the current status of reclaiming fees, it's essential to consult legal experts or consumer protection organizations. Keep your eyes peeled for any recent court decisions or announcements from Berliner Sparkasse or government agencies for further clarity.

- The study conducted by Innofact in May 2022 found that only 11% of adults surveyed had claimed unfair bank fees from their community institution, highlighting the need for more awareness and guidance from legal experts and consumer protection institutions.

- Despite the BGH ruling in April 2021 highlighting the need for explicit approval before altering institution fees, only 11% of adults surveyed had taken steps to reclaim their unlawful charges, suggesting a need for increased knowledge and proactive action in the business sector.