Top Dividend Shares Worth Investing in with a $10,000 Budget Instantaneously

The market has been generous to numerous investors in 2024, with the S&P 500 reaching new record highs at the close of 57 trading sessions so far. As the festive season approaches, it might be wise to think about treating yourself by investing for 2025. Investing in your future is one of the most rewarding presents you can give yourself. And if the gift is a consistent dividend stock, it could turn out to be a present that keeps on giving.

Many individuals receive a little extra money around the holidays, either from an end-of-year bonus, a seasonal side job, or a generous gift from a wealthy relative. Others might have bonds or CDs maturing, freeing up funds to reinvest. So, consider these two dividend stocks as long-term investment options if you have $10,000 (or any amount actually) to spare for investing.

1. Dell Technologies: Timing and opportunity

Large tech companies, such as Elon Musk's xAI, Microsoft, Meta Platforms, and others, are developing extensive data center facilities to exploit society's growing interest in artificial intelligence (AI). These colossal data centers cover at least 100,000 square feet (with some much larger) and are packed full of interconnected computer equipment. xAI currently operates a data center in Memphis with 100,000 GPUs powering servers that train AI models and plans to increase the center's capacity tenfold to meet its expanding demands. Dell is a major supplier for this xAI initiative, also providing equipment for Microsoft's data center in Wisconsin.

Growth in hyperscale data centers accelerated in 2023 and is estimated to surpass 1,000 in 2024. There are forecasts of 120 to 130 additional hyperscale centers coming online annually over the next few years.

These data centers require infrastructure like servers, racks, and cabling. As the market's leading supplier, Dell Technologies (DELL -0.01%) is ideally placed to benefit from this boom. Last quarter, Dell's Infrastructure Solutions Group (ISG) saw revenue soar by 34% year over year to $11.4 billion. The key driver in this segment was servers and networking, which increased by 58% to $7.4 billion, thanks to the data center business. In total, sales reached $24.4 billion with a 10% increase.

However, Dell's other segment, which provides computer solutions for businesses and individuals, did not perform as well, with a 1% reduction in revenue year over year to $10.1 billion in the same quarter. Despite this, Dell anticipates an upswing in demand driven by AI, although it's unlikely to contribute as much to growth as the ISG sector.

Dell plans to return 80% of its adjusted free cash flow to shareholders through share buybacks and dividends. The company aims to increase its dividend by at least 10% each year until at least fiscal 2028. Dividends increased by 20% when they were raised during this fiscal year. The forward yield is 1.26%. Although this yield is similar to the S&P 500 average, Dell is also expected to experience strong share price growth. Of the 25 analysts covering the stock, 21 advise buying or strongly buying, with an average price target of $151 per share – that's a 27% increase from the current price.

The demand for data center infrastructure places Dell in an advantageous position at an opportune time. Investors who buy in now stand to gain long-term benefits.

2. Vici Properties: A higher return

If you're seeking a high-yield income stock, the real estate investment trust (REIT) Vici Properties (VICI 0.28%) could be more suitable. Vici owns some of the world's most renowned properties, which it then rents out to well-known experiential brands.

These prestigious properties are challenging to replicate, thereby raising the entry barrier for competitors. They are also inhabited by large corporate tenants, like MGM Resorts International and Caesars Entertainment. This ensures that rent collection remains predictable, as even during unprecedented crises like the COVID-19 pandemic, Vici managed to collect 100% of its rents, despite many entertainment venues being temporarily closed.

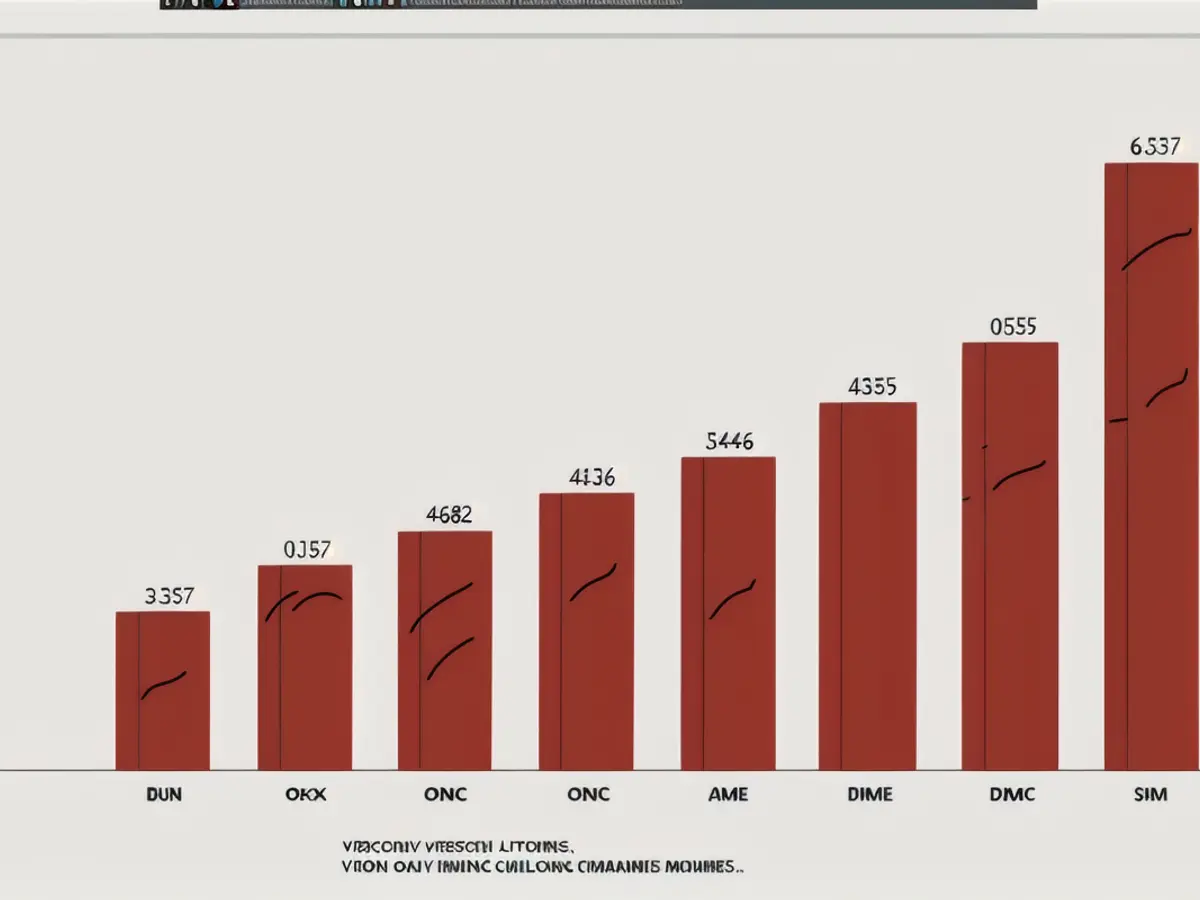

Vici has raised its dividend annually since its inception, and the growing funds from operations (used to pay the dividend) suggest this trend will continue as shown below.

The current forward yield is 5.5%, significantly higher than Dell's. However, Vici is unlikely to offer substantial share price gains; it is primarily a stock for consistent, growing income.

Dell and Vici offer distinct investment opportunities, providing investors with the choice between lower yield with possible share price growth or higher-yield income generation. Either may suit your investment strategy.

In light of the anticipated growth in hyperscale data centers, investing in Dell Technologies could be a wise financial decision for 2025, as the company's strong position in the market and promising dividend increases make it an attractive prospect. With a forward yield of 1.26% and analysts predicting a 27% share price increase, Dell offers a balance between income and potential capital gains.

If you're seeking a higher return with a focus on consistent dividend income, you might consider investing in Vici Properties. As a real estate investment trust, Vici offers a current forward yield of 5.5%, considerably higher than Dell's, and has managed to raise its dividend annually since its inception. While share price gains may not be substantial, Vici provides a reliable source of growing income.