Unveiling the Transformations in Russian Bank Transfers: Insights on Alla Khrapunova, Vera Sirenko, and the New Regulations

Transfers via Banking System May Not Raise Red Flags as Perceived by Alla Hrapunova

In the realm of financial dealings, a shift has occurred! Beginning June 1st, banks have been actively revising their approach to money transfers, conforming to new regulations that recently took effect in Russian legislation governing bank transfers.

These alterations primarily target limitations on transfers sans opening an account and amplified surveillance over financial transactions that might be linked to illicit activities or unauthorized entrepreneurship.

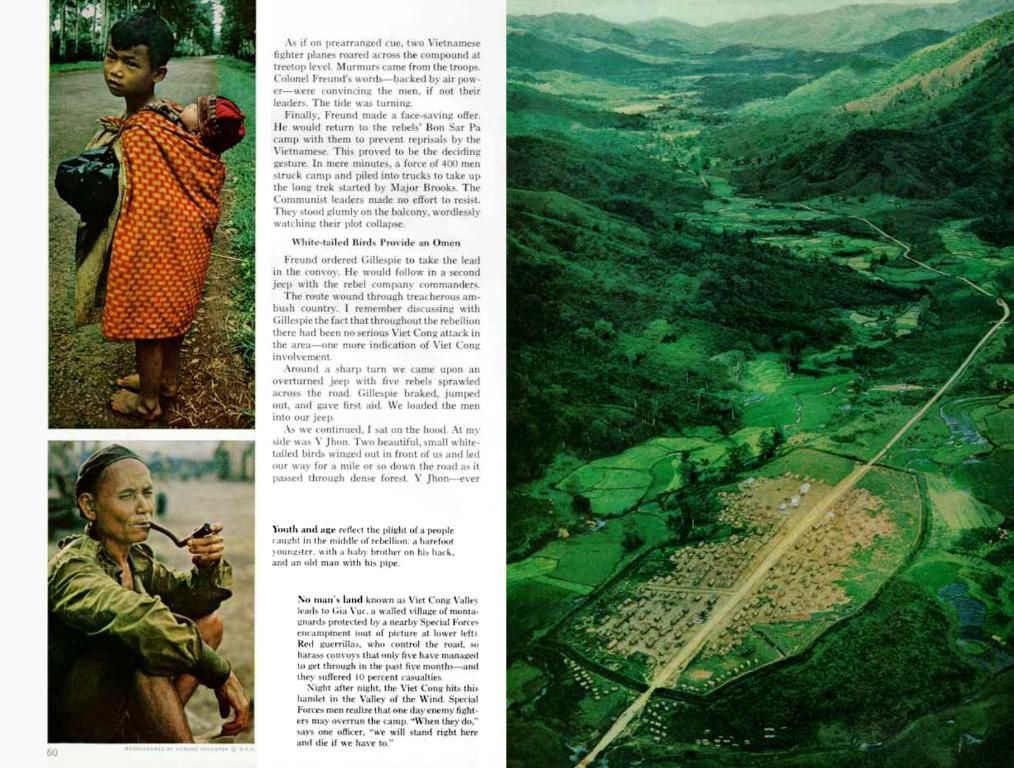

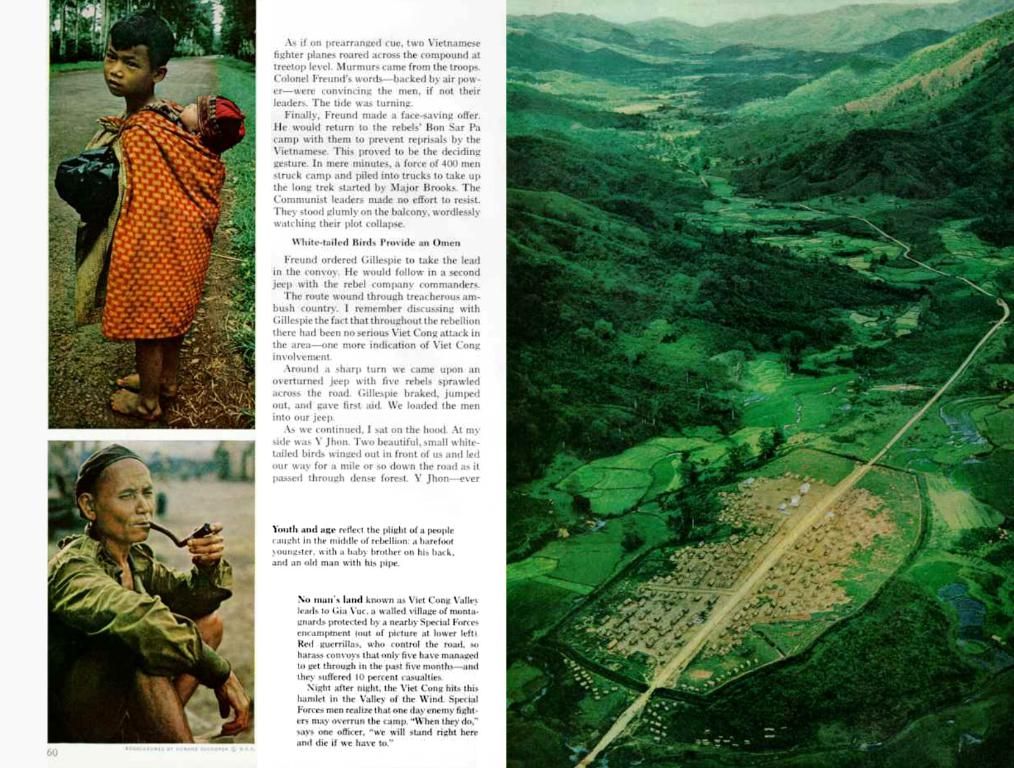

The talk of the town revolves around the potential consequences, such as card blocking or tax implications. To dispel these concerns and clarify the actual functioning of the new measures, notable figures Alla Khrapunova and Vera Sirenko, representing the "Details" project, delved into the topic.

Alla Khrapunova is the Deputy Director of the "Borrowers' Rights" Foundation and the Curator of the "Moshelovka.rf" platform. On the other hand, Vera Sirenko holds the position of Director at the accounting company "KubanPartner".

Highlighting Key Changes:

- Transfer Limitations Without Bank Account:

- Effective immediately, individuals can no longer transfer more than 100,000 rubles without opening a bank account, affecting both residents and non-residents[1][2][5].

- If someone desires to send amounts surpassing 100,000 rubles, they must present a full set of documents and undergo verification[1][5].

- Stricter Monitoring and Verification:

- Banks are authorized to inquire for additional details from senders for transactions exceeding 100,000 rubles, requiring information such as the transfer's purpose and recipient identity[1].

- Rosfinmonitoring can put a temporary halt on suspicious operations under investigation for up to ten days[2].

- Continuation of Existing Restrictions:

- The restrictions imposed on transferring funds abroad by the Bank of Russia have been prolonged until September 30, 2025, impacting non-resident individuals from hostile countries and legal entities from these states[3].

Prospective Consequences:

- Impact on Labor Migrants: The new regulations might pose challenges to millions of migrant workers, particularly those from Central Asia and other regions, who heavily rely on remittances. These changes may make it more complex for them to send money back home, potentially affecting their host countries' economies[1][5].

- Business Implications: The heightened scrutiny and documentation requirements might lead to more intricate procedures for businesses involved in international transactions, causing delays in financial operations and escalating compliance costs[1][2].

- Anti-Money Laundering Pursuits: The new regulations are part of a broader strategy to curb money laundering and unlawful financial activities. While they can bolster financial security, they may also contribute to increased costs and administrative burdens for individuals and businesses[4].

All in all, these new regulations aim to fortify financial oversight and compliance but may also introduce additional complexities and costs for individuals and businesses engaging in international money transfers.

In the updated financial landscape, the new regulations now prohibit transferring more than 100,000 rubles without a bank account, causing a shift for both residents and non-residents in their money transfer practices (business). This stricter approach includes banks requesting additional details for transactions over 100,000 rubles, such as the transfer's purpose and recipient identity, and Rosfinmonitoring's temporary halts on suspicious transactions (finance, banking-and-insurance). These changes may have significant implications for businesses involved in international transactions, as they may face increased complexity and compliance costs (business). Furthermore, labor migrants, particularly those from Central Asia and other regions, might encounter challenges when sending remittances due to these new regulations (industry).