When's the interest rate rollercoaster heading our way? Trump's back-and-forth with the Fed on US inflation

Trump exerts influence on the U.S. Federal Reserve, citing "impressive figures"

Are we about to experience a rate hike or a drop? It seems the global financial landscape is as unpredictable as a rollercoaster ride, with US President Trump putting pressure on the Federal Reserve to make a move on interest rates.

Consumer prices in the USA unexpectedly remained steady in May, despite higher import tariffs, according to the Labor Department. The inflation rate clocked in at 2.4% year-on-year, slightly lower than the analysts' expectations of 2.5%. On a monthly basis, consumer prices rose by a mere 0.1%, less than anticipated, mainly due to lower gasoline prices.

Trump, on his social media platform Truth Social, commented excitedly on the price development, "Great numbers!" Meanwhile, he added fuel to the fire by urging the Federal Reserve to slash key interest rates. "The Fed should cut it by a full point. Then we would pay much less interest on outstanding debts. So important!!", Trump tweeted in capital letters.

Economists remain skeptical, as the effects of the tariff increases might not be fully felt yet. "The evolution of US consumer prices remains puzzling," said economist Elmar Völker of Landesbank Baden-Württemberg (LBBW). "Even in May, there was no sign of the aftermath of Donald Trump's massive tariff hikes." Retailers might still be selling previously well-stocked inventory, according to Völker.

The ongoing tariff games between Trump and numerous countries might eventually result in inflation building up gradually over several months, as claimed by economist Bastian Hepperle of Hauck Aufhäuser Lampe Privatbank AG. However, these tariff-induced price increases could become more apparent over the summer.

Meanwhile, despite White House calls for a rate cut, the independent US Central Bank has kept its rates steady. Fed Chairman Jerome Powell stated that they are closely monitoring Trump's policy changes to gain further clarity regarding their effect on inflation and the labor market. The next rate decision is set for June 18, and most experts do not expect a rate cut until September.

In summary, despite the ongoing economic turbulence caused by tariff disputes, there is currently no definitive indication from the Federal Reserve about an upcoming interest rate adjustment. Analysts' predictions for the first rate cut in September 2025 are based on further economic developments and the evolution of inflation and the labor market. The Fed remains cautious and focused on maintaining a steady course until it's time to make a move. Until then, financially savvy riders might choose to hold onto their rollercoaster tickets and brace for the inevitable ups and downs ahead.

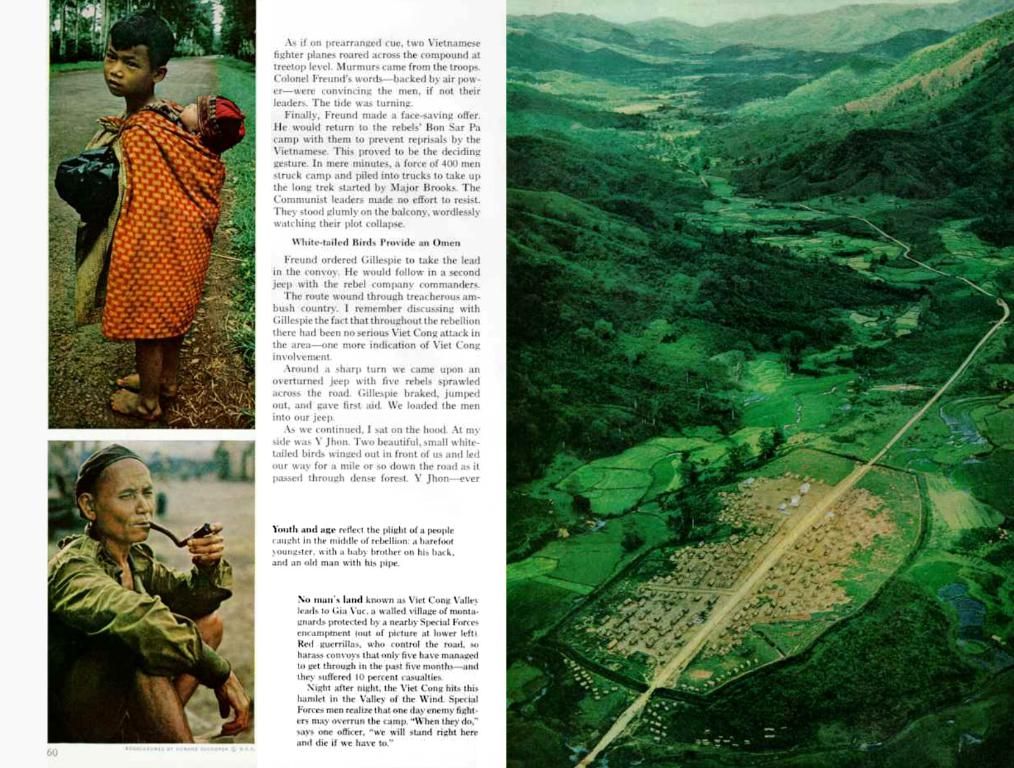

- Inflation

- Economic Cycle

- Consumer Prices

- Monetary Policy

- Fed

- Donald Trump

- USA

Additional Insights- The slowdown in the US economy and persistently high inflation levels are causing concern among Fed officials, leading some to question the accuracy of inflation data- Caution is key as the Fed evaluates the impact of President Trump's policies, such as tariffs and immigration restrictions, on inflation dynamics

- The increase in consumer prices in the USA, despite higher import tariffs, could indicate a potential impact of Donald Trump's policies on the inflation rate.

- Despite Donald Trump's urging for the Federal Reserve to slash key interest rates, the independent US Central Bank has maintained its rates steady, showing cautious approach towards monetary policy until the full effects of Trump's trade policies on inflation and the labor market are understood.